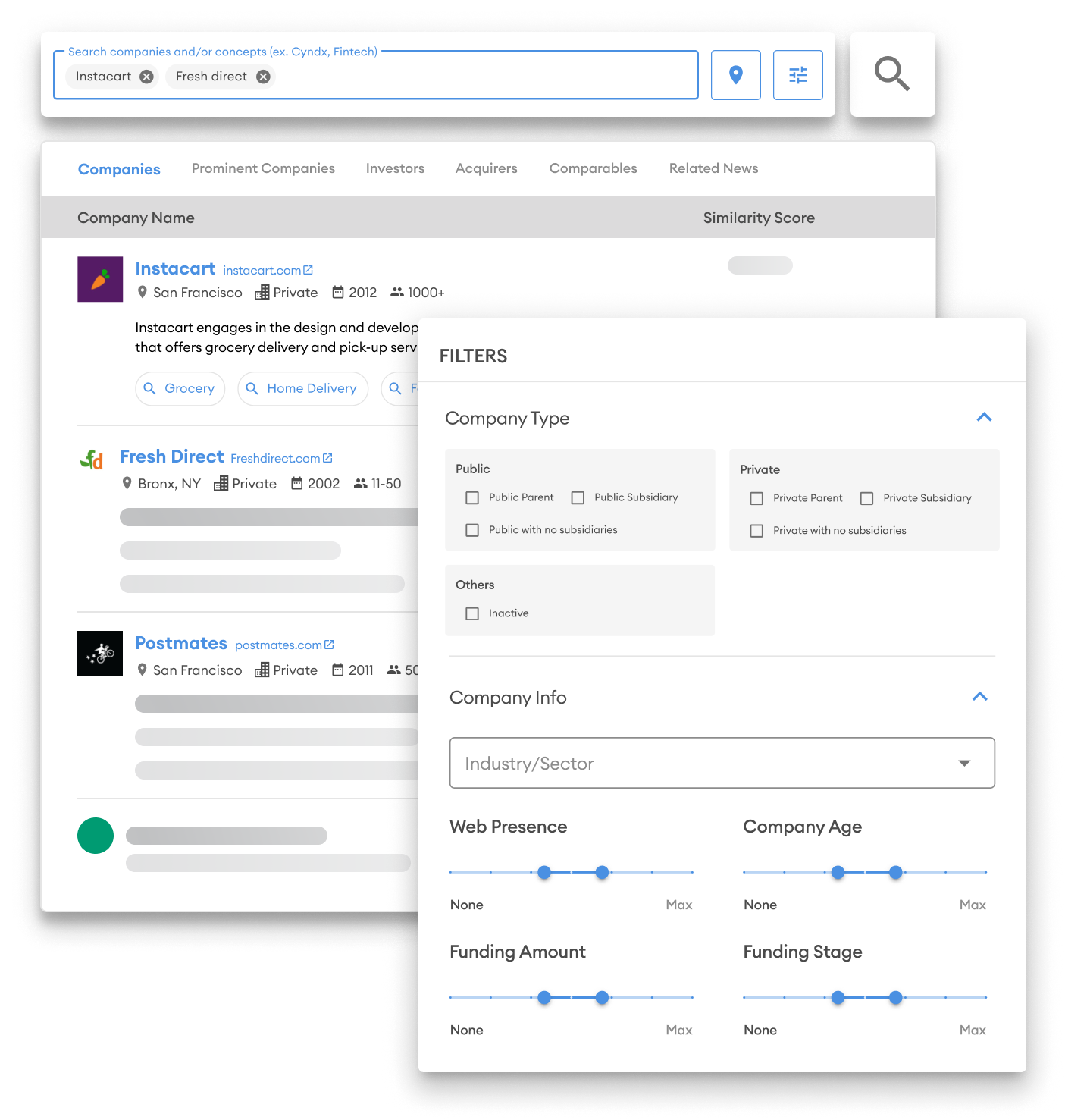

Cyndx Finder is an AI-powered deal search and discovery engine that uses machine learning and natural language processing to identify closely-similar companies for deal sourcing, client prospecting, and much more.

Cyndx Finder makes it simple to find and connect with potential acquisition targets. Our M&A software is purpose-built to help you find and evaluate the best matches and acquisition targets for your company based on your goals.

"Projected to Raise" is Cyndx’s proprietary algorithm that ingests and analyzes large amounts of data. The output determines which private companies are likely candidates for an equity offering in the next six months.

See the industry competitive landscape and complete the picture of your competitors’ offerings and overall funding performance with our data and AI. Uncover a new AI market map of the opportunities that includes ways to engage and capture deals.

With Cyndx Finder, you can get a list of the right deal opportunities immediately. Cyndx Finder uses AI to ingest and analyze data on millions of companies and transactions, understand current market conditions in the context of your search query, and provide a precise list of opportunities. It's AI deal origination software for modern dealmakers. If your company maintains that you need a connection before reaching out, upload your LinkedIn, CRM or personal contacts to see who you know at a company using our Connector feature.

Streamline the entire deal searching process and reap valuable information leveraging Cyndx Finder’s dynamic mapping capabilities. Dynamic mapping frees companies from static, historical classifications, so you see all of the relevant players in a particular market. Easily search targets in niche, emerging, or intersecting verticals.

With over 32M+ companies market data from multiple sources (traditional, alternative and proprietary), our AI deal sourcing platform covers a broader dataset than any other software. As the dataset grows, so does the platform’s intelligence — which means our AI-powered results are ever more relevant and precise.

Cyndx Finder allows you to gain visibility into new markets with fresh data that sheds light on where and what it takes to capitalize on an emerging opportunity. Holistic data will inform your deal strategy with AI and data-driven insights. Cyndx's "Projected to Raise" algorithm identifies companies that are projected to raise capital within the next six months. Our AI deal sourcing platform changes your entire process.

Identify deal opportunities that truly match your mandate.

0+

Companies

0+

Languages

0+

Countries

0%

Concepts

Cyndx scrapes, translates, and analyzes native language-only domains in seven languages besides English, enabling users to easily explore, map, and break into global markets.

Projected to Raise uses Cyndx proprietary AI to identify companies likely to need raise capital within the next six months, with over 86% accuracy.

Use Cyndx’s proprietary AI to identify relevant target companies for acquisition through concepts and keywords. Use the “similar companies” button to discover unknown companies for potential M&A activity.

Enter a specific term or industry subcategory to search and map sectors by concept. Concepts are dynamically mapped and constantly updated, making them far more accurate and adaptable than keywords.

Stay on top of market activity and trends. Filter and target emerging opportunities to engage in the most promising deals. Network with the deal targets you need to communicate with directly.

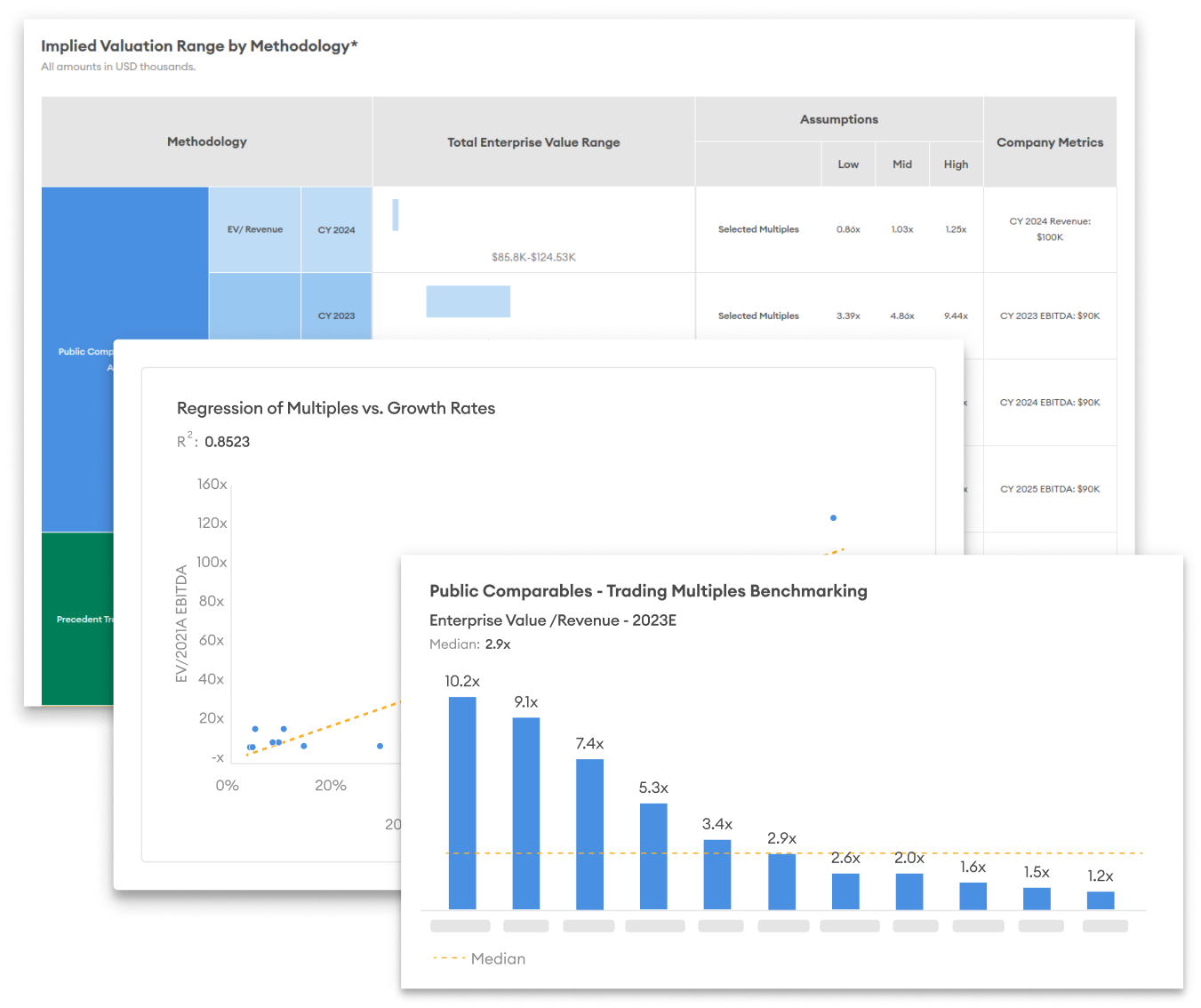

Figure out how much money a private company is worth based on the trading multiples of publicly traded companies in the same industry, and run different scenarios for select companies.

View the profitability of a company—EBITDA, revenue, debt, and cash and equivalent.

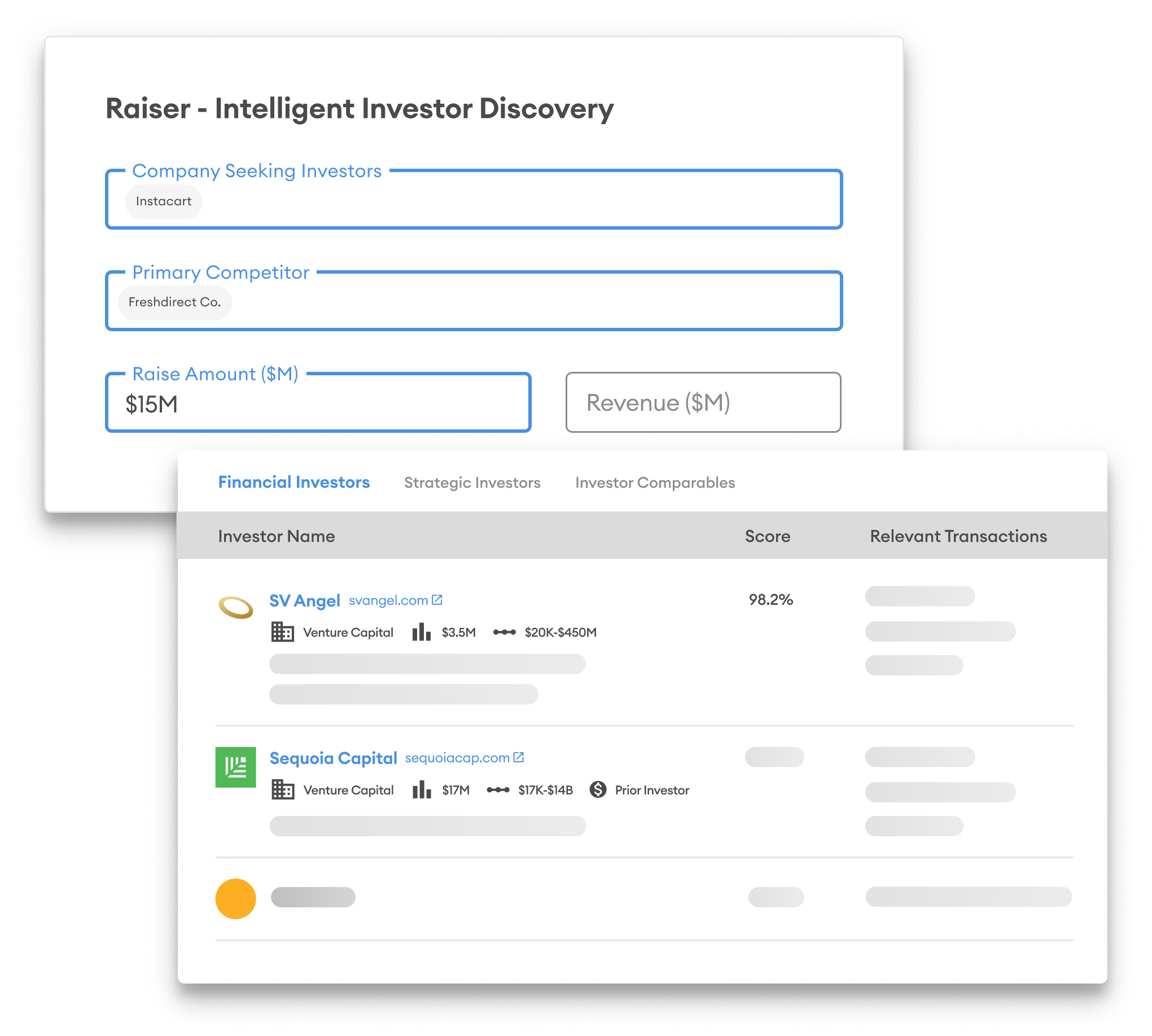

Identify the most active investors in any vertical. Dive deeper into their portfolios by using filters like median deal size and historical investment range.

Integrate Cyndx’s search engine with your CRM system and identify historical institutional touchpoints faster. Export Cyndx-generated company or target lists to your CRM system.

Map your competitors, identify bolt-on ideas for clients, and predict potential acquisition opportunities using Cyndx’s proprietary algorithm. Our M&A software uses purpose-built AI and is state-of-the-art.

Identify new investment or bolt-on acquisition opportunities by enhancing your coverage effort and institutionalizing relationships with leading global private equity firms. Map industry landscapes and competitors.

Identify new investments or bolt-on acquisition opportunities. Map industry landscapes and competitors with AI market mapping.

"We just got started with the Cyndx platform and within the first week booked six new client conversations with niche private equity firms. We had never heard of these specialized firms before using Finder on the Cyndx platform."

Senior Advisor

"We used Cyndx to curate a list of over 300 acquisition targets that were closely aligned with our strategic objectives, ultimately leading to multiple successful M&As."

Corporate development, Senior Manager

"We were in a bind and needed a list of acquisition targets for our client immediately. The Cyndx M&A platform came through and delivered a targeted list for our clients. "

Wealth manager

"As a financial advisor, my mind is blown by how many years I wasted without a tool like Cyndx. I can pull market maps for a client in seconds, show them competing IP, comparables, and help them plan the right timing for exit. No other tool has made it easier to find the right buyers."

Financial Advisor

"I shared the results from Finder with my clients. They said it was the single most productive meeting they've had in 20 years. They were absolutely elated with the details and information. "

Investment banker

"Cyndx's Finder – their deal origination platform using the acquisition fit tool – presented us with excellent new targets for our clients. "

Senior Manager

"Cyndx's Finder provides an easy-to-use and powerful search tool with a broad range of use cases that I use almost every day. Customer service is excellent and quick to respond to questions. "

Investment banker

Learn more about what’s happening in the market right now that can help your business grow.

February 24, 2026

February 18, 2026

February 12, 2026

February 10, 2026

Find answers to most commonly asked questions related to our products and services

Yes, it assists in the discovery and evaluation of potential investment opportunities, strategic partnerships, and acquisition targets. The platform grants access to an extensive database comprising companies, investors, and valuable market insights.

Cyndx Finder is more sector driven. It will show a full view of active players in a market. On the other hand, Cyndx Raiser is more transaction-specific. It will show how to find the best match for a particular fundraise or strategic acquirer.

Dynamic mapping refers to how companies are “mapped” by their relative similarity—so, companies which are more similar are closer together, while companies which are less similar are further apart.

Cyndx can potentially help to shorten this process by screening for companies with certain characteristics (financials, IP, strategic fit) during the initial search. Our Scholar product is built specifically for due diligence and cuts down the research process to minutes.

Yes. Cyndx has a custom comparables tab which shows all companies with financials in the cohort to better understand how private companies in that space will be trading. You can view financial multiples in a list and dynamically update your preferred comparison by selecting or removing companies to include.