Learn how purpose-built AI makes all the difference for research and due diligence. Create sophisticated, secure due diligence reports and PowerPoint decks in minutes with our generative AI tools.

Identify deal opportunities that truly match your mandate.

0+

Companies

0+

Languages

0+

Countries

0%

Concepts

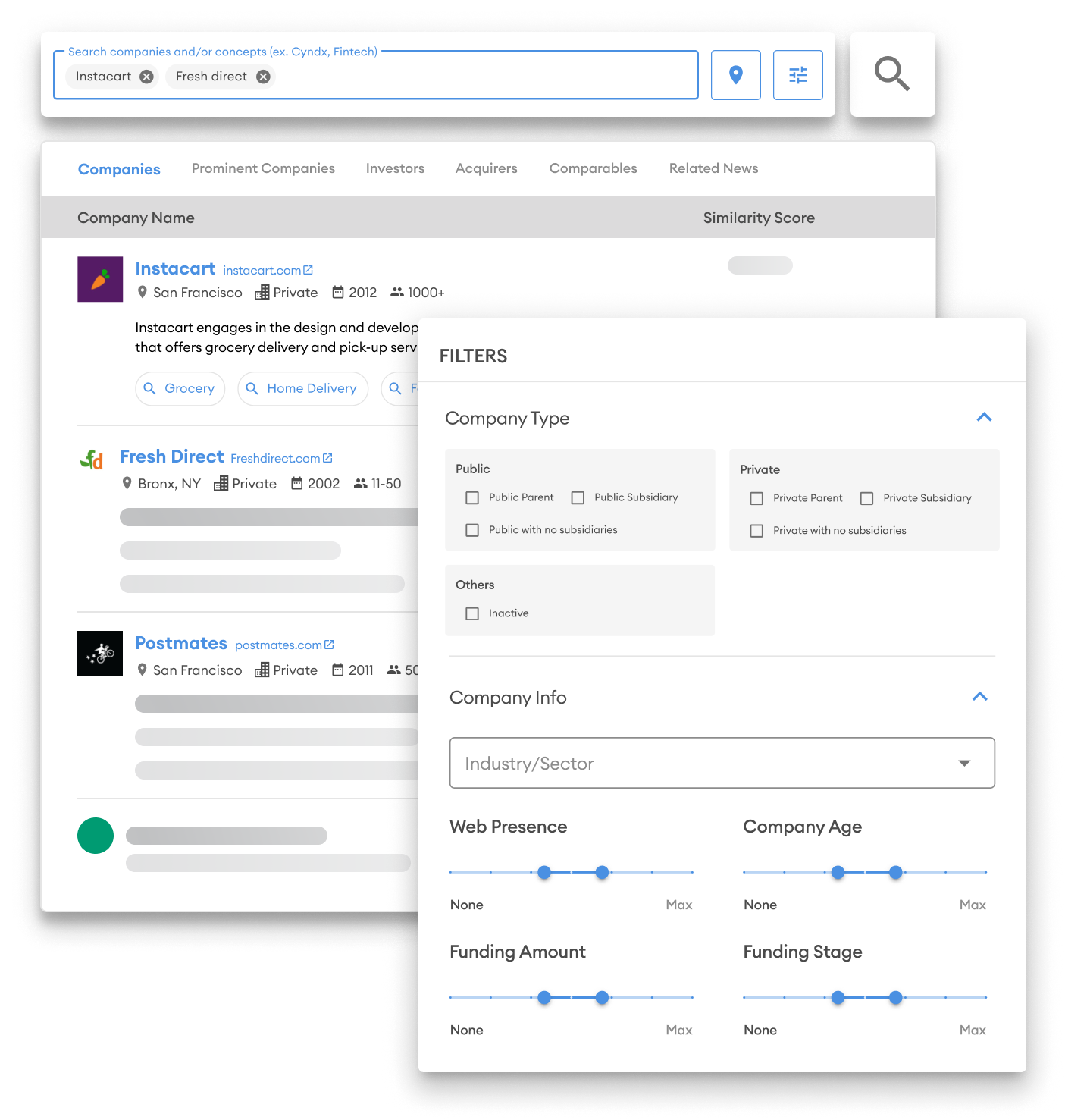

Cyndx’s Finder, our deal sourcing platform, uses AI and enables you to quickly map niche markets and industries to uncover new opportunities. - Find new opportunities in global markets regardless of the sector - Dynamic NLP that evolves with changing markets - Use our Connector tool to see who you know at companies

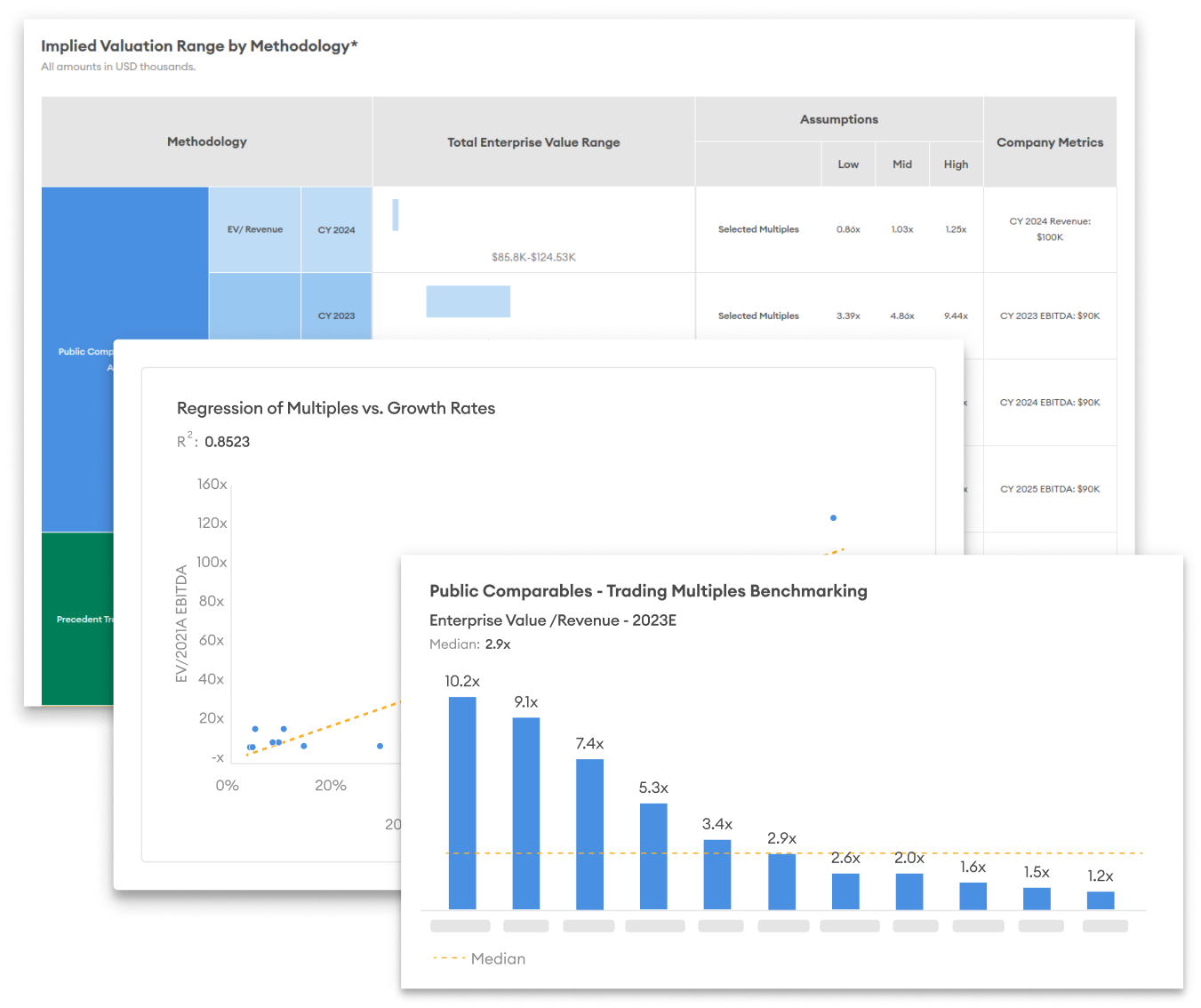

Valer, our business valuation software, creates customizable valuation reports in minutes. Users securely upload their financial information and then leverage our proprietary algorithms, AI and data to create a professional-grade report. Our valuation method was designed by an investment banker and the report includes: - Adjustable DCF and VC - Public comparables - Precedent transactions - Adjustable WACC - Adjustable PGR

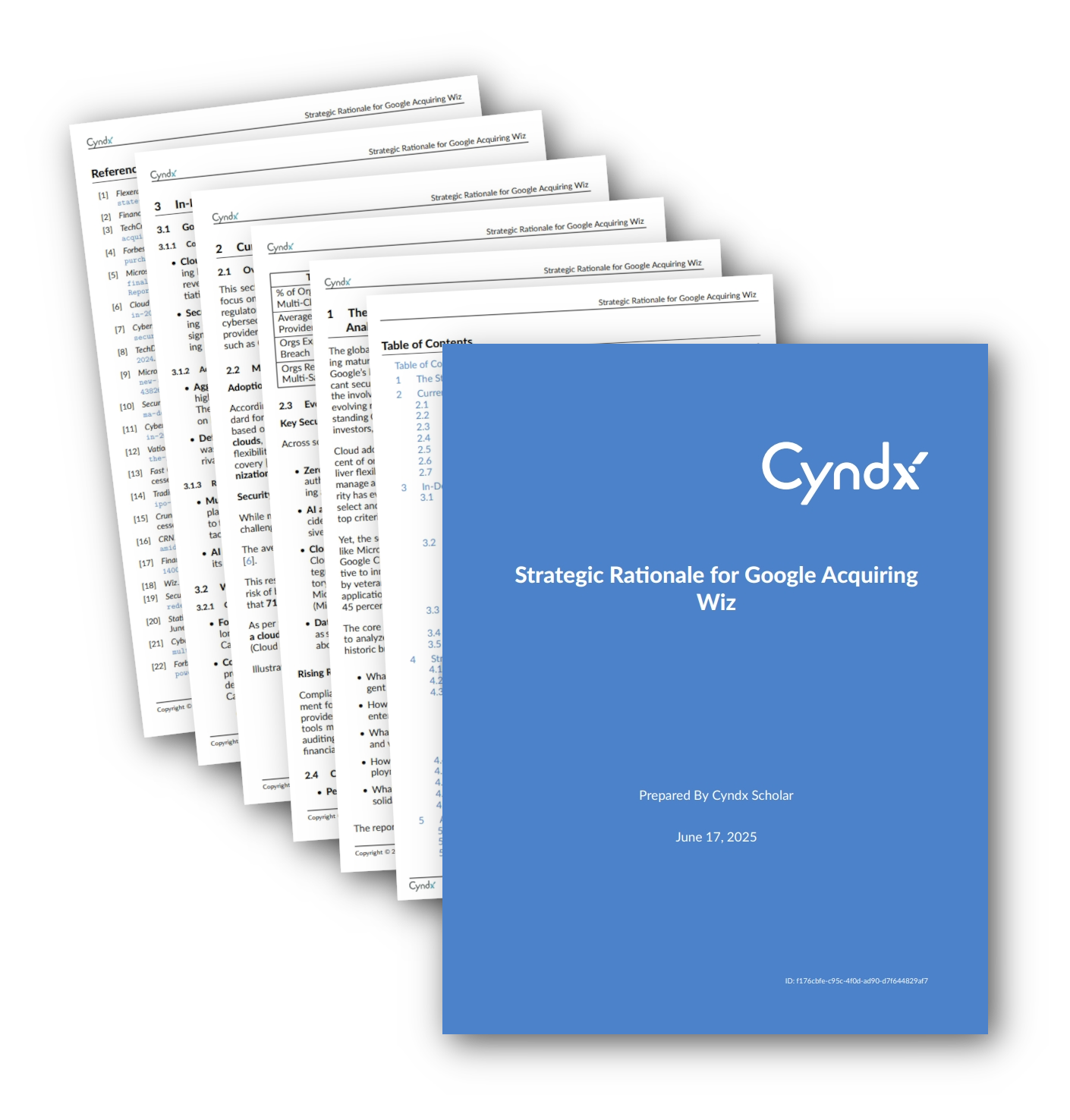

Scholar, our purpose-built Gen AI deep research and due diligence tool, is changing the industry. Type in a research query and our AI agents create a sophisticated 50+ page research report in minutes. Our research is all backed up with high-quality citations so you can verify the work. Your data is safe, secure and private on our platform. We never use your data to train our models. - Scholar applies Gen AI to our proprietary data as well as any uploaded documents and external resources. - Reports use our proprietary algorithms for our deal sourcing, capital raise and acquisition fit tools. - Download the highlights as a PowerPoint deck. Brand assets are also available to download.

Identify companies projected to raise capital soon with our predictive analytics and our Acquirer product. Access robust profiles with funding data, growth metrics, IP, financials, and contact information for quality-assured deal results and more than 86% precision rates.

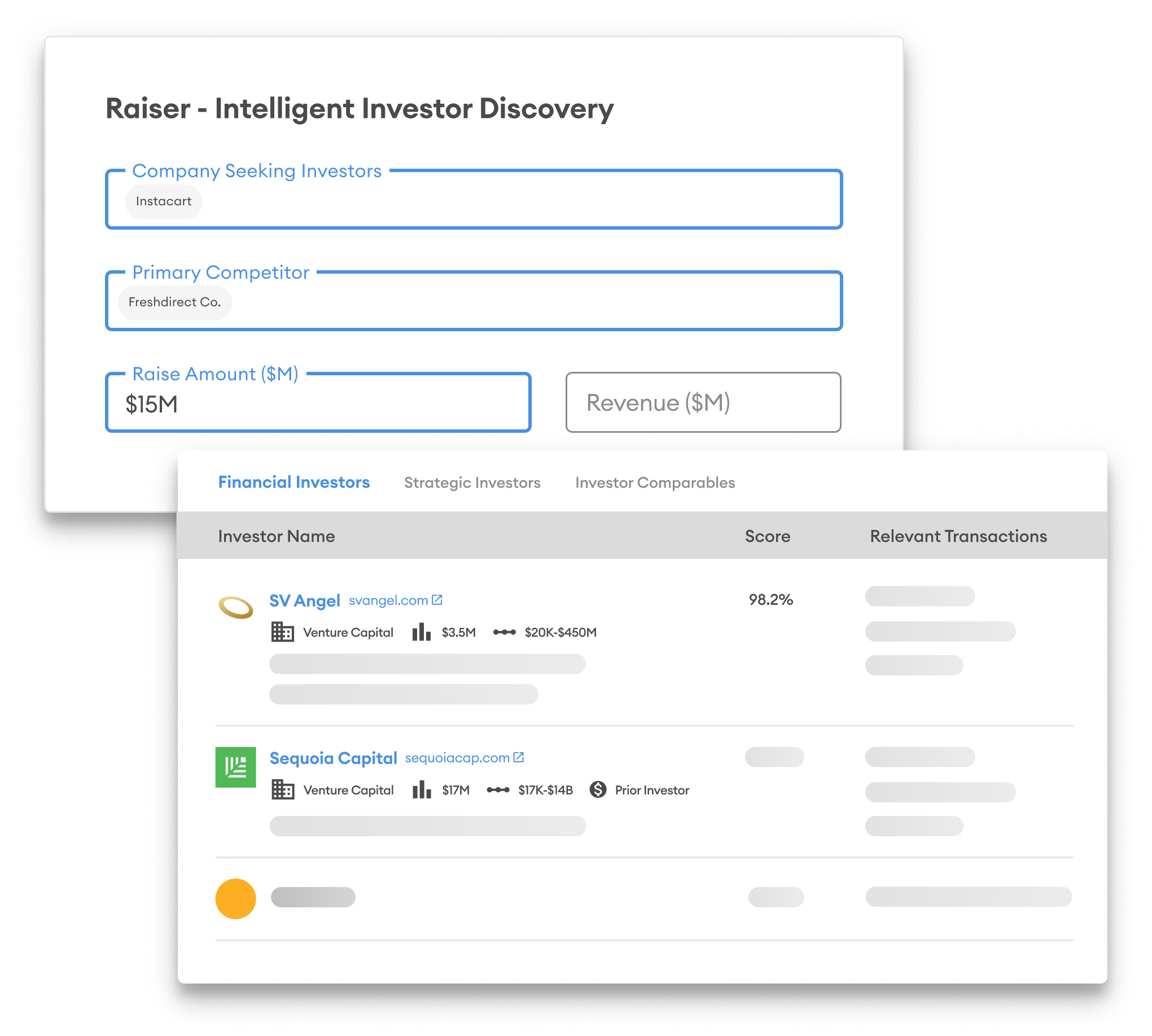

Find the right investor in seconds. Cyndx Raiser analyzes billions of data points with AI to discover the best financial and strategic investors for your sector, deal size, goals, and funding stage. Create curated lists and filter by your funding priorities. Access investor contact information without leaving the platform. - Create lists of investors aligned with your priorities - Straightforward search that is easy to use - View similarity scores, portfolio insights, investing history, company growth metrics and other details not easily accessible

Loading...

Learn more about what’s happening in the market right now that can help your business grow.

February 24, 2026

February 18, 2026

February 12, 2026

February 10, 2026

Find answers to most commonly asked questions related to our products and services

Cyndx is an AI-driven financial technology company that provides a platform to simplify fundraising and M&A activities. Cyndx uses its advanced algorithms to accurately curate and rank investor lists, increasing the efficiency of capital raising and M&A transactions for entrepreneurs, private equity firms, venture capital firms, and more.

With Cyndx, you can discover potential acquisition targets, identify strategic partners, conduct in-depth research in minutes and access market insights to support growth strategies.

Yes, Cyndx provides businesses with a powerful platform for deal sourcing, helping them discover and evaluate potential investment opportunities, strategic partnerships, and acquisition targets. The platform offers access to company profiles, financial information, growth metrics, funding history, and industry trends to support informed decision-making. It offers access to a vast database of companies, investors, and market insights to support informed decision-making.

Yes, Cyndx Valer derives your company’s value using Cyndx’s massive dataset and AI-powered methods. In less than an hour, you get a sophisticated valuation analysis that you can present to banks, investors and acquirers.