An AI-Driven Business Valuation

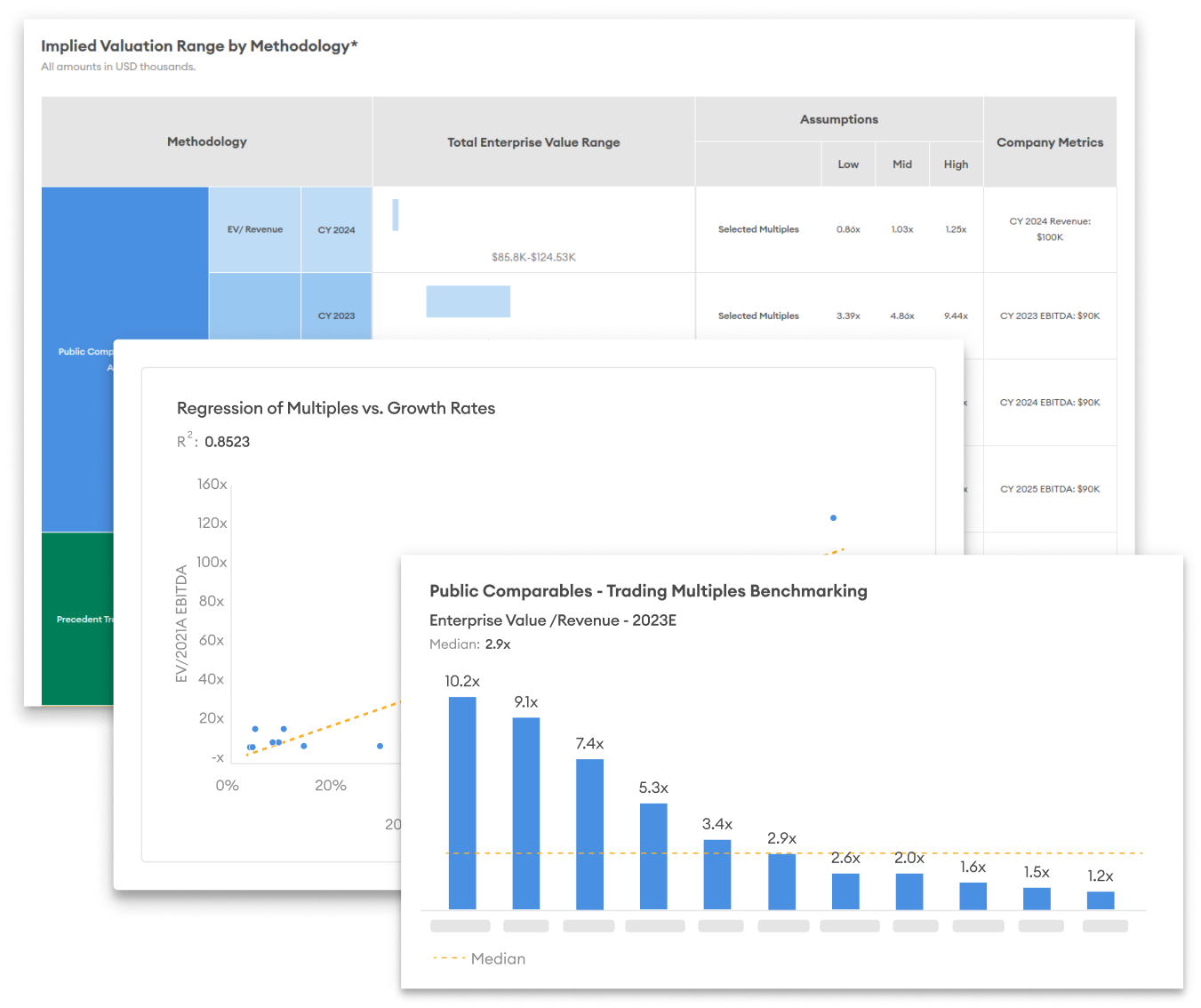

Our business valuation software determines the value of a company in minutes, not weeks. Use our proprietary algorithms, AI and data to access in-depth company valuations. Valer analyzes market trends, financial metrics, and historical patterns to create professional-grade valuation reports.

After clients provide company financial information, our AI compares it against relevant market data and trends. This includes comparable company multiples, expected returns for private and public companies and long-term growth projections to provide a relevant valuation report.

Valer provides fully customizable reports tailored to your specific criteria. We allow a flexible approach to adapt to your audience and unique needs.

Private precedent transactions are also accessible on Valer.

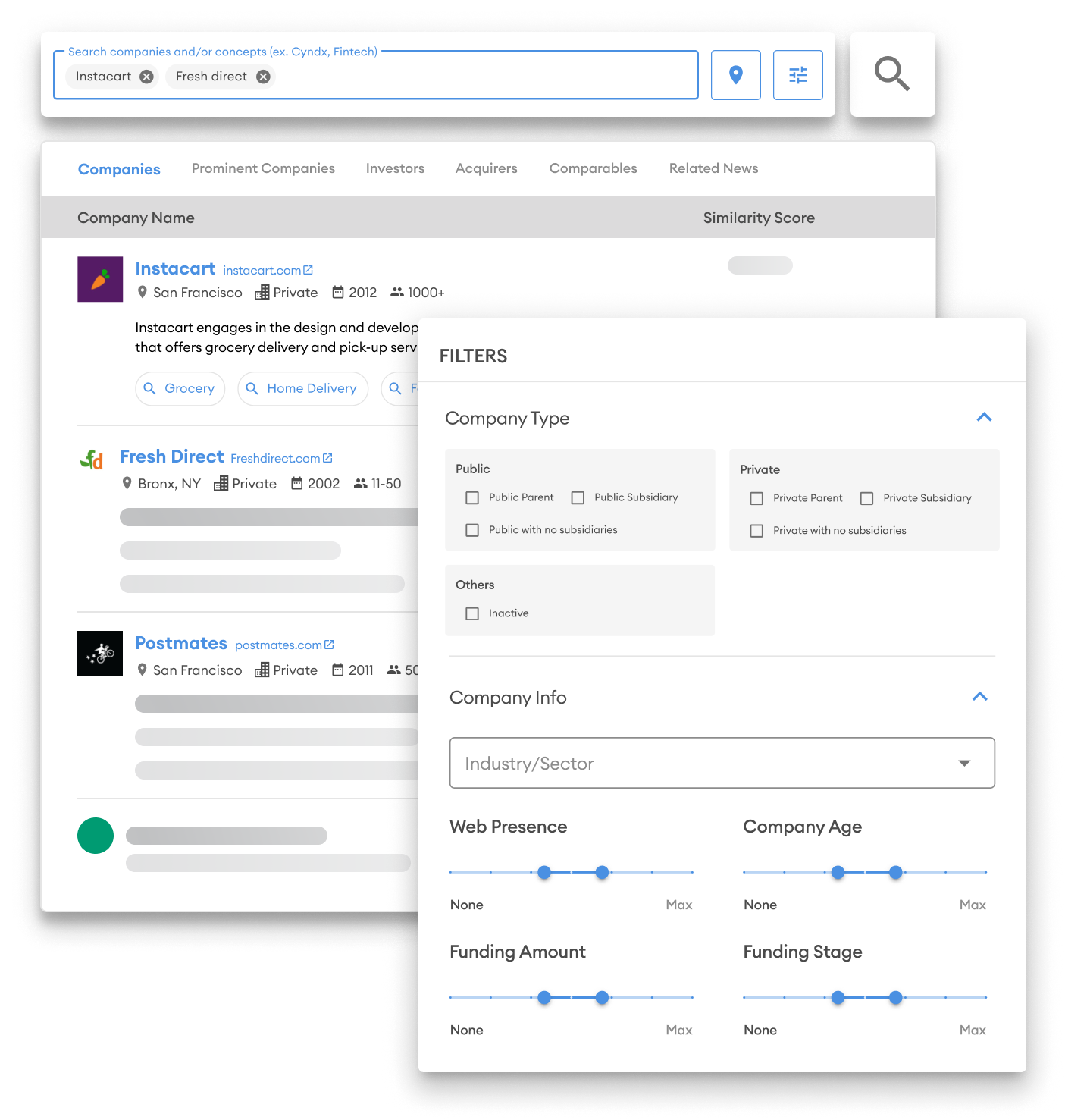

Access AI-driven public comparables.

Leverage our proprietary AI and extensive dataset to accurately determine your company’s valuation by benchmarking against similar companies in the market.

Proprietary AI to identify the business value

Input some financial information in our business valuation software and compare it against relevant market data—including comparables, expected returns, and growth projections.

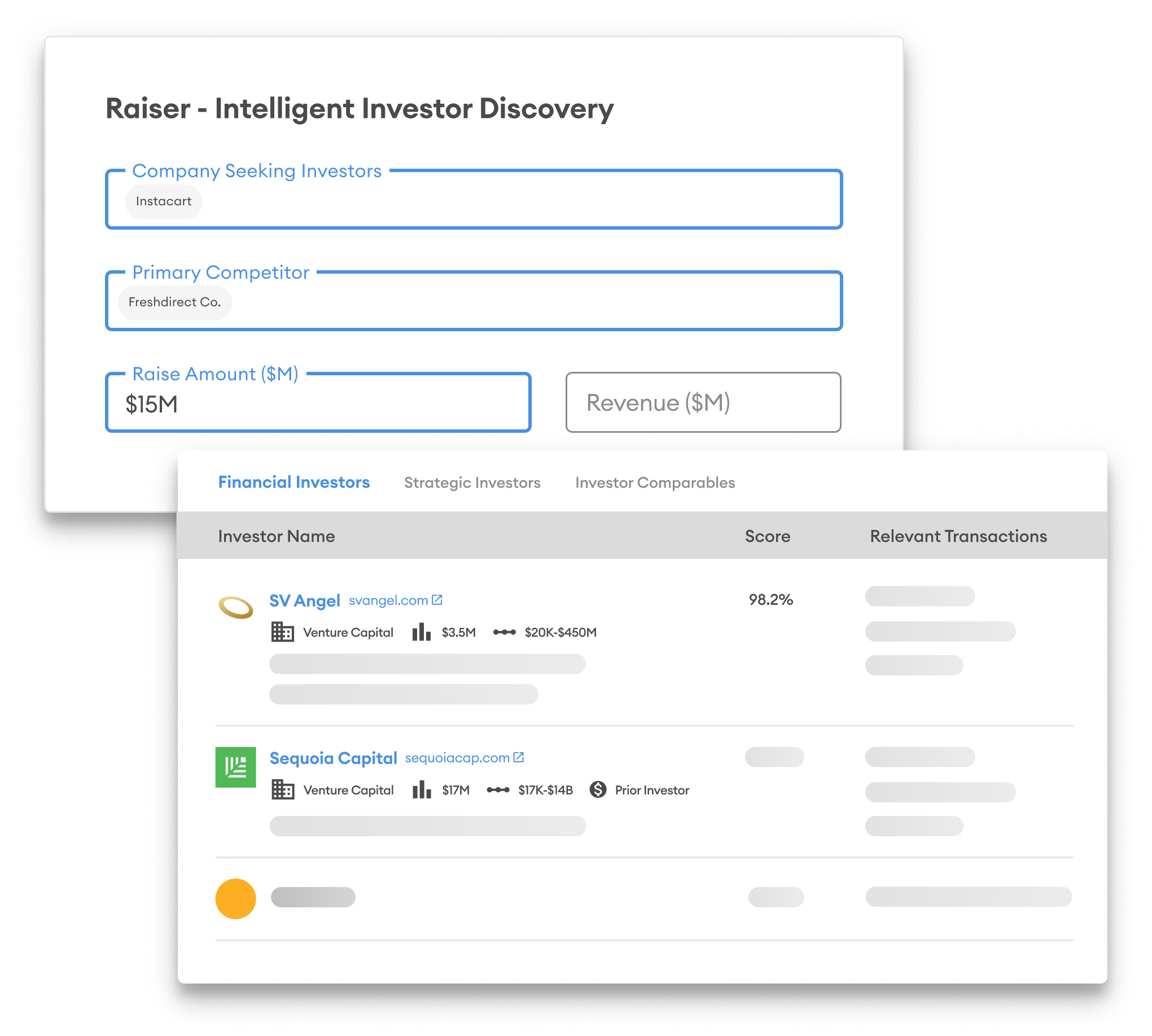

Gain valuable insights into your company’s worth

The combination of a global corporate dataset with proprietary AI enables us to deliver accurate, insightful company valuations.

Valer helps you prepare for critical discussions in capital raising or M&A activity.