An AI-Driven Business Valuation

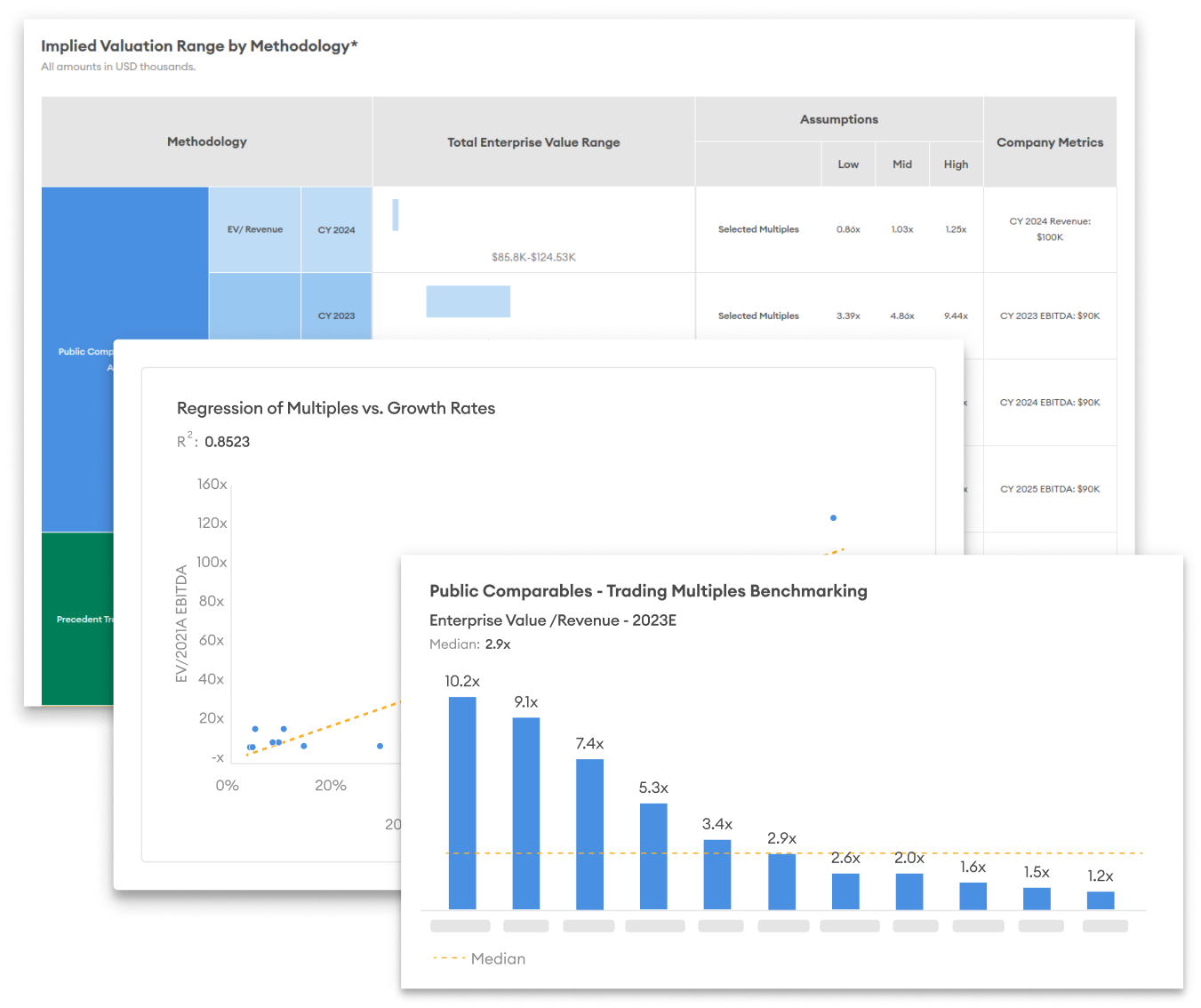

Our business valuation software creates a framework for determining the value of a company in minutes, not weeks. Leverage our proprietary algorithms, AI and data analytics to gain precise valuation assessments by dynamically analyzing market trends, financial metrics, and historical patterns across public and private companies.

After users provide company financial information, our AI compares it against relevant market data and trends — including comparable company multiples, expected returns for private and public companies and long-term growth projections to give you a relevant valuation of your company.

We provide fully customizable reports tailored to your specific criteria with a flexible valuation approach that adapts to your audience, unique needs and preferences.

Private precedent transactions are also accessible on Valer.

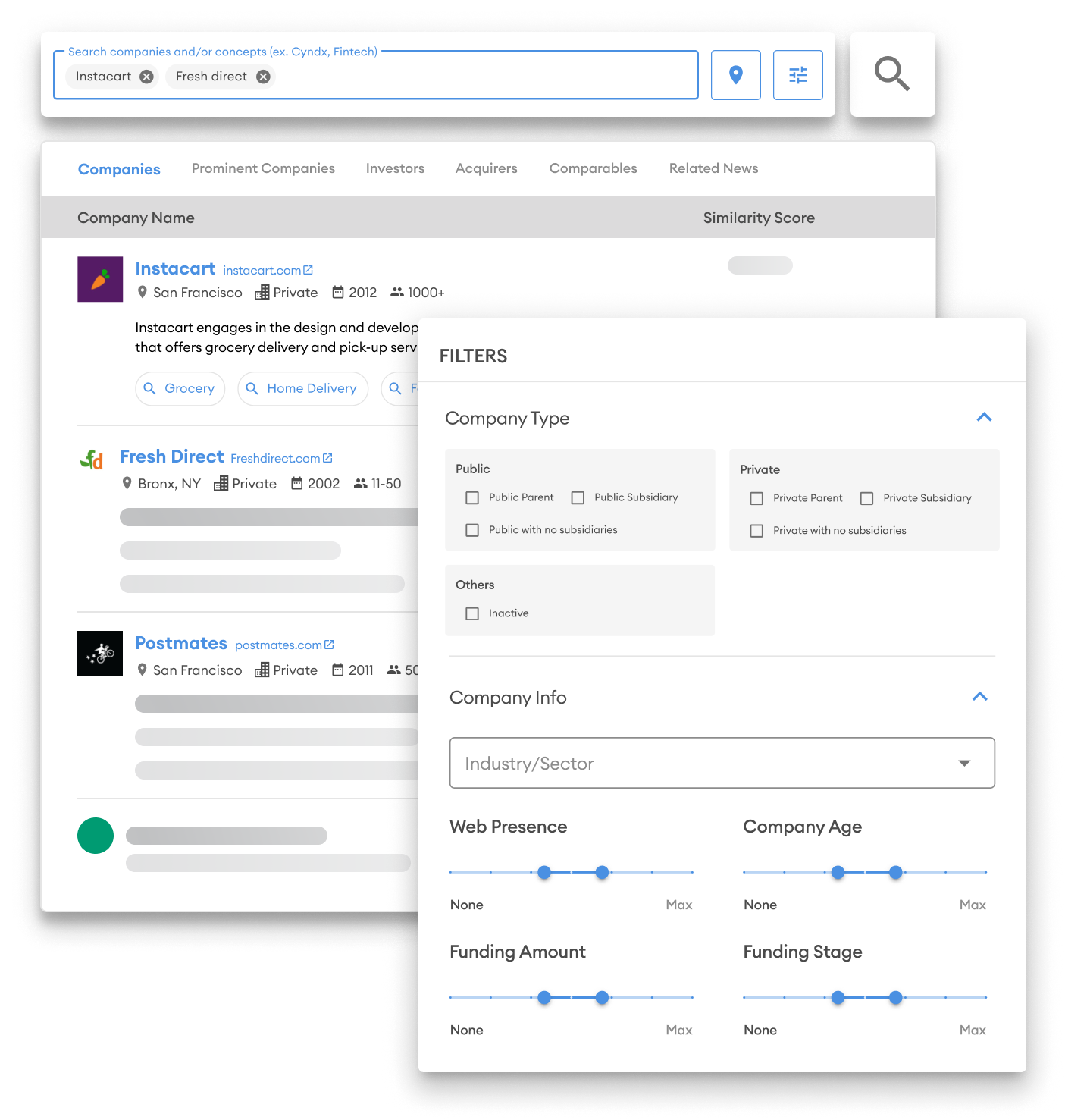

Access AI-driven public comparables.

Leverage our proprietary AI and extensive dataset to accurately determine your company’s valuation by benchmarking against similar companies in the market.

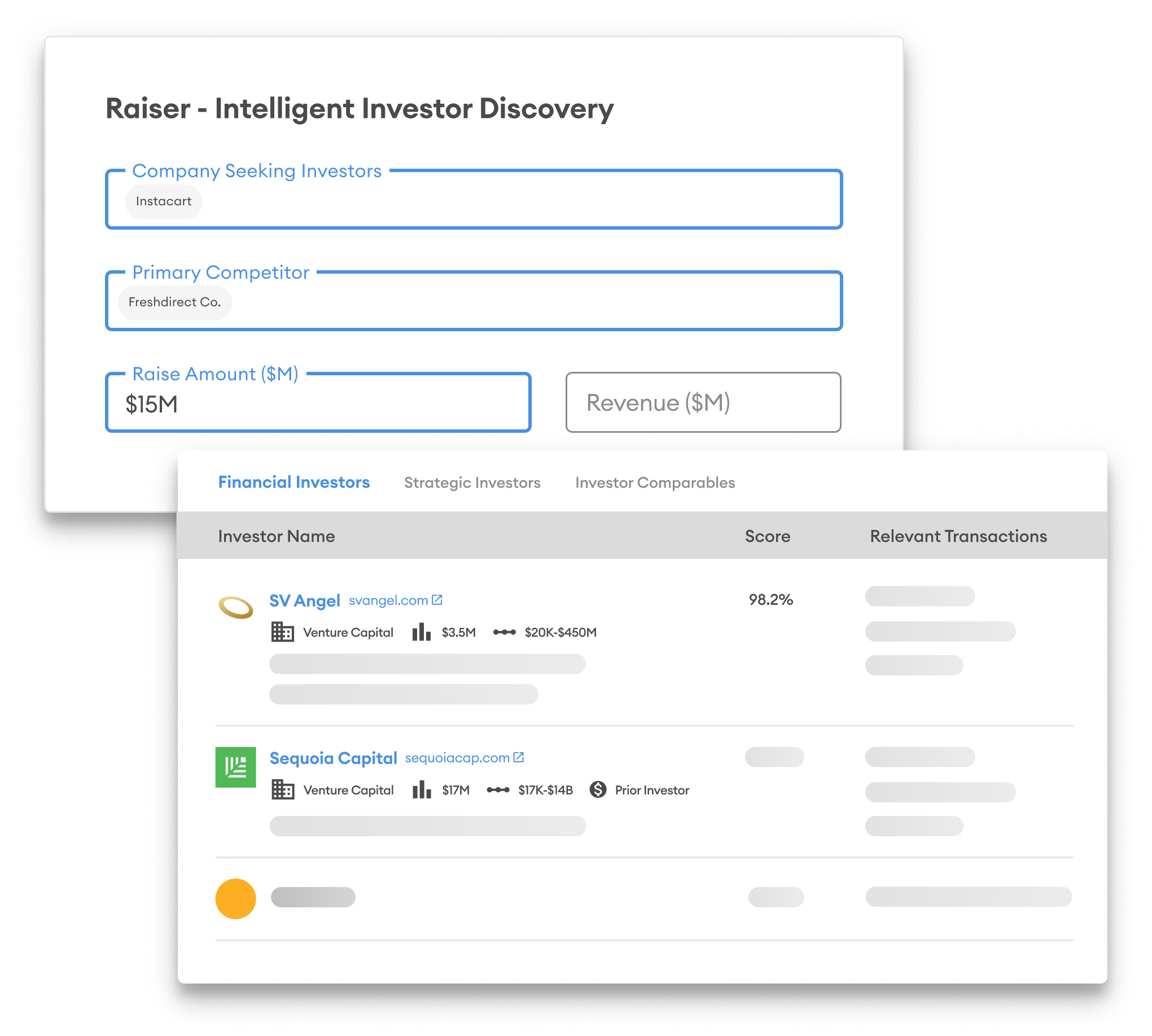

Proprietary AI to identify the business value

Input some financial information in our business valuation software and compare it against relevant market data—including comparables, expected returns, and growth projections.

Gain valuable insights into your company’s worth

The combination of a global corporate dataset with proprietary AI enables us to deliver accurate, insightful company valuations.

Valer helps you prepare for critical discussions in capital raising or M&A activity.