An AI-Driven Business Valuation

Valer creates a framework for determining the value of a company in minutes, not weeks. Leverage Cyndx’s advanced, proprietary algorithms and data analytics to gain precise valuation assessments by dynamically analyzing market trends, financial metrics, and historical patterns globally across both public and private companies.

After users provide company-specific financial information, our AI compares it against relevant market data and trends — including comparable company multiples, expected returns for private and public companies and long-term growth projections to give you a relevant valuation of your company.

We provide fully customizable reports tailored to your specific criteria with a flexible valuation approach that adapts to your audience, unique needs and preferences.

Private precedent transactions are also accessible on Valer.

Quickly determine more accurate company valuations

Determining an appropriate and defensible valuation for a company, typically isn’t a simple or quick process. It’s a very complex process that if done wrong can have significant implications.

Valer is a sophisticated tool designed to deliver investment banker-level valuation services for any company, regardless of sector, size, or geography. Valer calculates a company’s value by leveraging both public and private datasets as well as utilizing AI-driven methods such as DCF, VC, public comparables, and precedent transactions.

Reduce margins of error in valuation

Traditional valuation methodologies rely on intelligence and judgment. These time-consuming processes often lack critical information or have manual errors in inputs like earnings statements or identifying the most appropriate comparables. Any mistakes can potentially have a significant impact on a company’s valuation.

Valer addresses these challenges by utilizing a proprietary dataset and AI, along with built-in methodologies such as discounted cash flow, venture capital, public comparables, and private precedent transactions, to deliver a more accurate and efficient valuation with fewer opportunities for error. Valer also allows the user to customize and refine the output to reflect their unique preferences.

Make more educated decision

A company’s valuation is essential whether you’re issuing equity to employees, raising capital, or selling the business. For entrepreneurs and growth-stage companies, Valer offers a streamlined framework to determine your company’s worth.

By leveraging Cyndx’s advanced proprietary algorithms and data analytics, our platform quickly delivers a detailed valuation analysis. Our pre-built framework provides fully customizable reports tailored to your specific criteria, with a flexible valuation approach that adapts to your audience, unique needs, and preferences. This analysis is ready to present to banks, investors, or potential acquirers, making it an invaluable asset for a variety of financial scenarios.

Use a proven business valuation model

It’s time-consuming and costly for all sizes of businesses to hire a professional appraiser.

Valer simplifies this process by allowing you to easily input your business and financial information to accurately determine your company’s value. Quickly obtain a reliable valuation without the need for extensive resources.

Our pre-built framework provides fully customizable reports tailored to your specific criteria, with a flexible valuation approach that adapts to your audience, unique needs, and preferences. This analysis is ready to present to banks, investors, or potential acquirers, making it a critical asset for various financial scenarios.

Identify investment opportunities which truly match your mandate.

Accurately pinpoint growth opportunities and risks

Private Precedent Transactions

See what the most comparable companies have sold for so that you are prepared for any negotiations or upcoming valuation discussions.

Relevant Private Comparables

Access private company data that’s organized and easily searchable. Make well-informed decisions about your competitive environment and how you should be positioned.

Custom Public Comparables

Determine the value of a private company based on the public trading multiples of the most relevant companies in the same industry.

Liquidation Value

Understand the potential valuation of your business, whether your issuing equity to employees, raising capital, selling or liquidating your assets. The valuation framework for a business allows more informed decisions about investments and to plan effectively for exit goals.

Discounted Cash Flow

Utilizing a vast proprietary dataset and AI, along with built-in methodologies such as discounted cash flow, we deliver a more accurate and efficient valuation with fewer opportunities for error. Users can customize and refine the output to reflect their unique preferences.

Equity

Receive a comprehensive report on your company’s equity, featuring clearly stated assumptions, calculations, and a detailed breakdown of any differences in your value compared to similar firms.

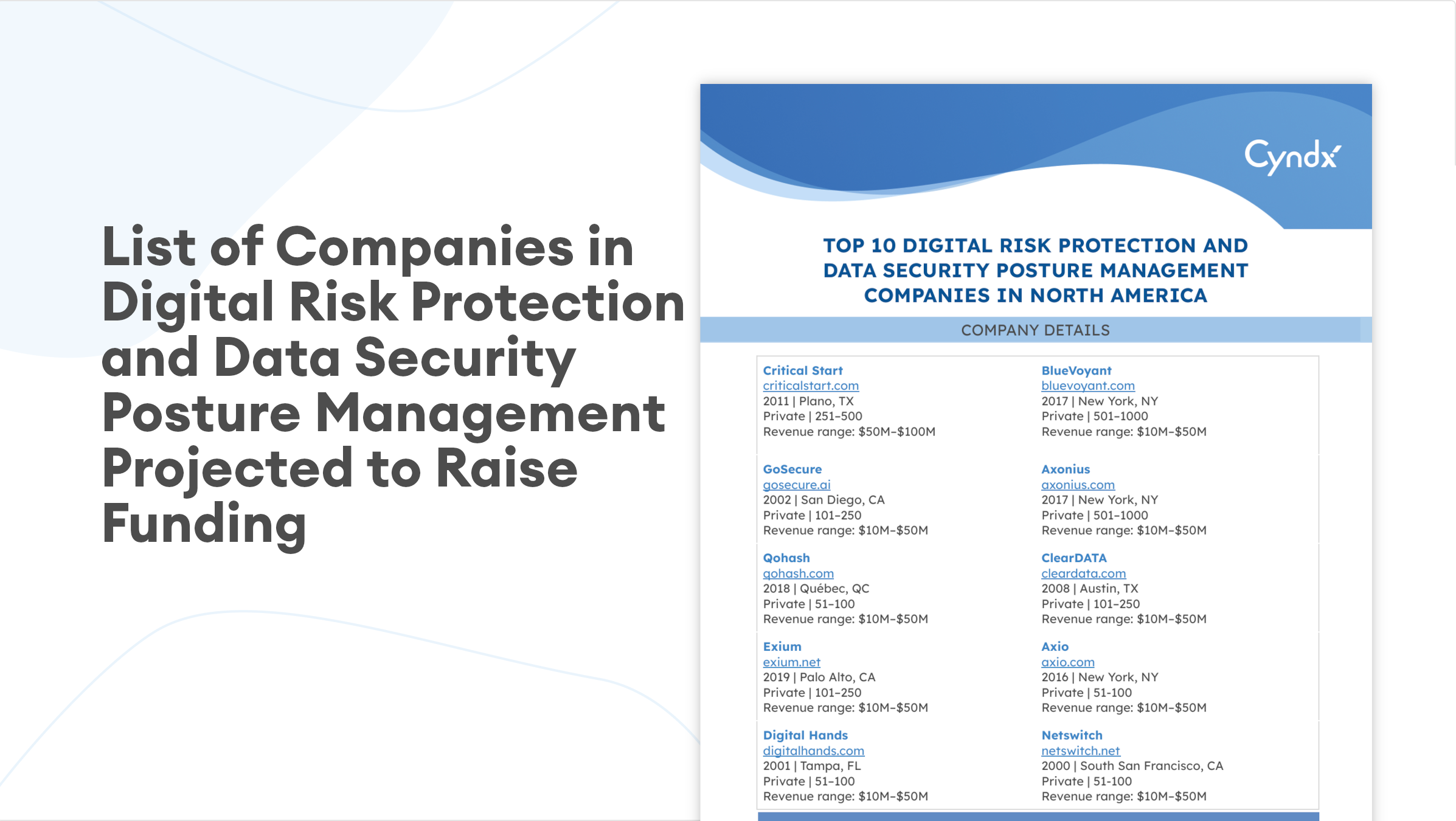

Explore our resources.

Learn more about what’s happening in the market right now that can help

your business grow.