One Platform. Three Solutions.

Cyndx’s Starter Kit is an all-in-one package designed to help you jumpstart your fundraising efforts by curating a clear capital raising by identifying the most likely and relevant potential investment partners. Backed by the market’s most extensive private company dataset, giving users unmatched reach and precision in discovering capital, middle market companies poised for growth and acquisition opportunities.

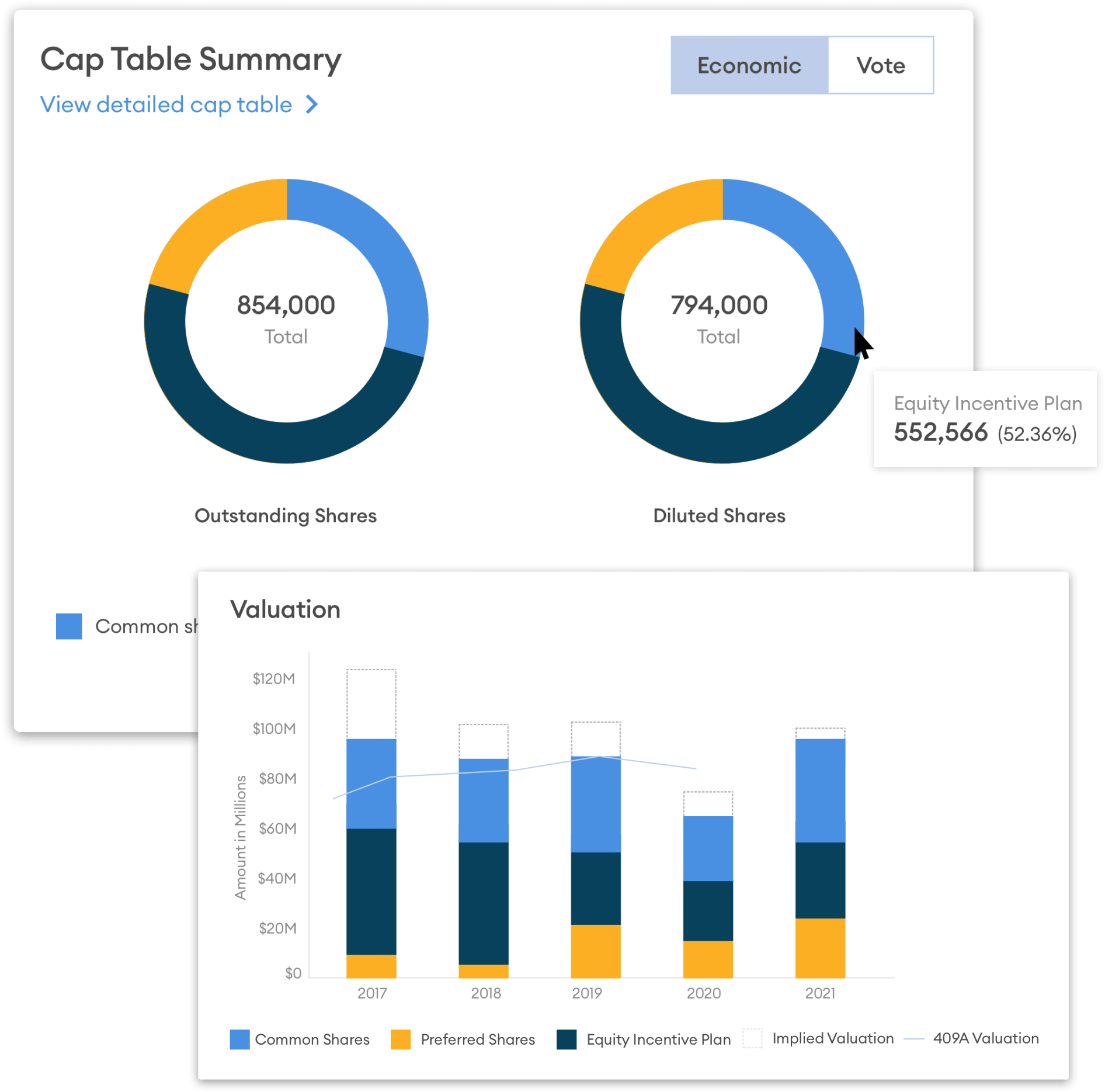

Manage and understand your capital structure.

Build cap tables, stock option plans, and vesting schedules using an easy-to-use cap table management software that gives you a unified view of your capital structure and powerful scenario modeling capabilities to evaluate how deals will impact ownership.

Boost your credibility in front of prospect investors.

Cyndx understands the challenges most entrepreneurs face when getting in front of investors. It can take time to earn an investor’s trust, especially if you’re a new entrepreneur. With Cyndx’s Starter Kit, you’ll have more insights about your business, understand the implication of your potential capital raise and better understand the driver of value for your business in a unified view so that you can be better positioned to engage with potential investors.

Make the most of every deal sourcing opportunity.

How Our clients Use Cyndx

01

Entrepreneurs Create a data driven, thoughtful pitch for your next fundraise and map comprehensive markets with a single search to enhance your relationships with leading global investors.

02

Investment Bankers Discover, research and engage with the most relevant middle market companies. Be in front of transactions before they happen. Bring timely, relevant data into your discussions and analysis — keeping your due diligence process efficient and organized with a platform that collects all the relevant data in one place.

03

Private Equity / Venture Capital Funds Identify emerging trends, capital and IP formation. Have timely and relevant topics to engage with your prospective postpects. Be in front of potential investment opportunities and acquisition opportunities before they happen.

Explore our resources.

Learn more about what’s happening in the market right now that can help

your business grow.