Achieve greater speed and certainty.

When you’re comparing thousands of deals, how do you know which opportunities to pursue? Experience can only go so far, but not a single person — even an expert — can learn everything that’s happening in a certain space. Cyndx brings greater speed and certainty to the VC deal process. Cyndx gives you a quick, easy way to supplement your expertise and sharpen your judgment with comprehensive views of the entire market.

Smarter Screening

Quickly assess potential engagements with AI & ML.

Superior Coverage

Map global markets in seconds.

Actionable Insights

Predict companies seeking capital and other events.

Map market verticals,

in seconds.

Simply type in a company or industry term, hit search, and see everything you need to know to qualify a company or map a market vertical, in seconds. Whether you want to build a pipeline of proprietary deals, streamline screening and diligence for deal prospects, or help portfolio companies find the right co-investors, Cyndx can help.

Streamline due diligence.

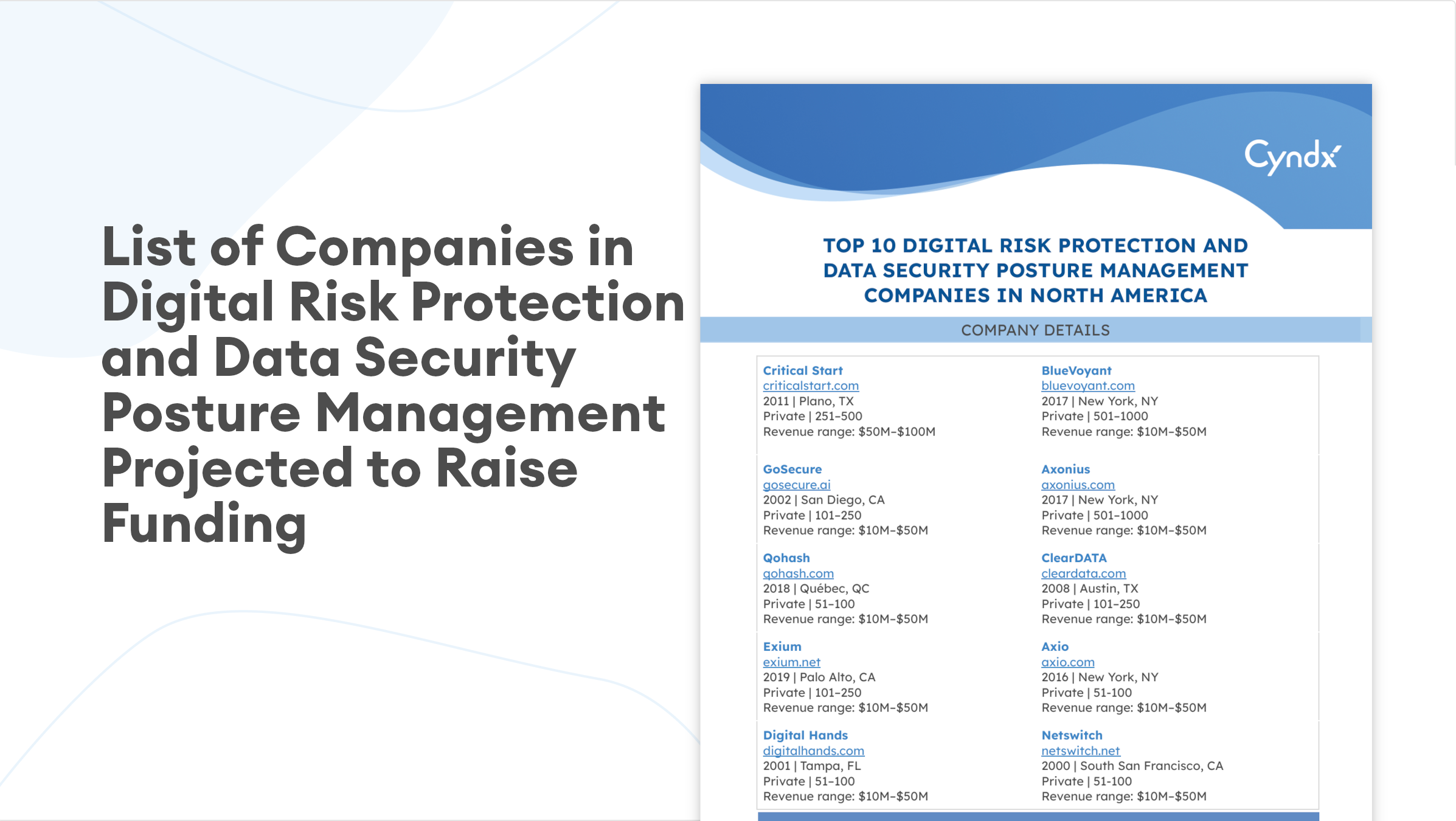

Quickly create complete competitive landscapes for any deal prospect. Map lookalike companies (public or private) in any space, plus investors and acquirers. Cyndx’s dynamic, NLP-derived classifications make it simple to survey all the relevant players, even in an emerging or fragmented space.

Spot hidden gems.

Cyndx Finder lets you access private and public market data in seconds.

Search from over 30M+ companies — 60K+ of them are public companies. Filter your search by funding stage, location, financials, and other customizable criteria to find the most relevant enterprises for your investment strategy.

Contextual data helps you spot companies of interest. Explore growth metrics, media and event presence, social sentiment, patent holdings, and more.

Build the right relationships.

Identify potential investors or co-investors with Cyndx Raiser. Proprietary algorithms use your deal criteria to assess millions of transactions and identify the most relevant strategic or financial investors based on industry, deal size, funding stage, and other factors. See which buyers or investors to reach out to, with C-level contact information, in seconds.

Identify investment opportunities which truly match your mandate.

Stay on top of hot sectors and pinpoint the most promising investment and acquisition opportunities.

Keep your CRM data up-to-date, and give it a boost by integrating with the Cyndx platform.

Enhance team efficiency by list-making, linking, and tagging make it easy to collaborate.

Help portfolio companies grow by track cap tables, store diligence documents, and find the right potential acquirers, all with one tool.

Identify companies projected to raise additional capital within the next six months.

Explore our resources.

Learn more about what’s happening in the market right now that can help

your business grow.