The Future of the Investment Banking Analyst: Augmented, Not Replaced

Forget everything you've heard about artificial intelligence (AI) stealing Wall

The Sparkle of the 4th: What Makes the $3B Fireworks Industry Boom

As America gears up for another spectacular 4th of July

Agentic Workflow: How AI Agents Research, Analyze and Review Deals

The dealmaking game just got a major upgrade, and it’s

Cyndx Just Launched Scholar, And It’s Going to Change How You Research Deals Forever

Research reports that used to take weeks? Scholar does them

Transforming to an AI‑First Enterprise: The Role of Corporate Development

A decade ago, corporate development teams lived in spreadsheets and

How CPA Firms Became the Hottest Target in Private Equity

For decades, accounting firms were viewed as the buttoned-up corner

The Great Summer Getaway and How Small-Group Tours Are Leading the Travel Boom

Memorial Day doesn’t just honor those who served in the

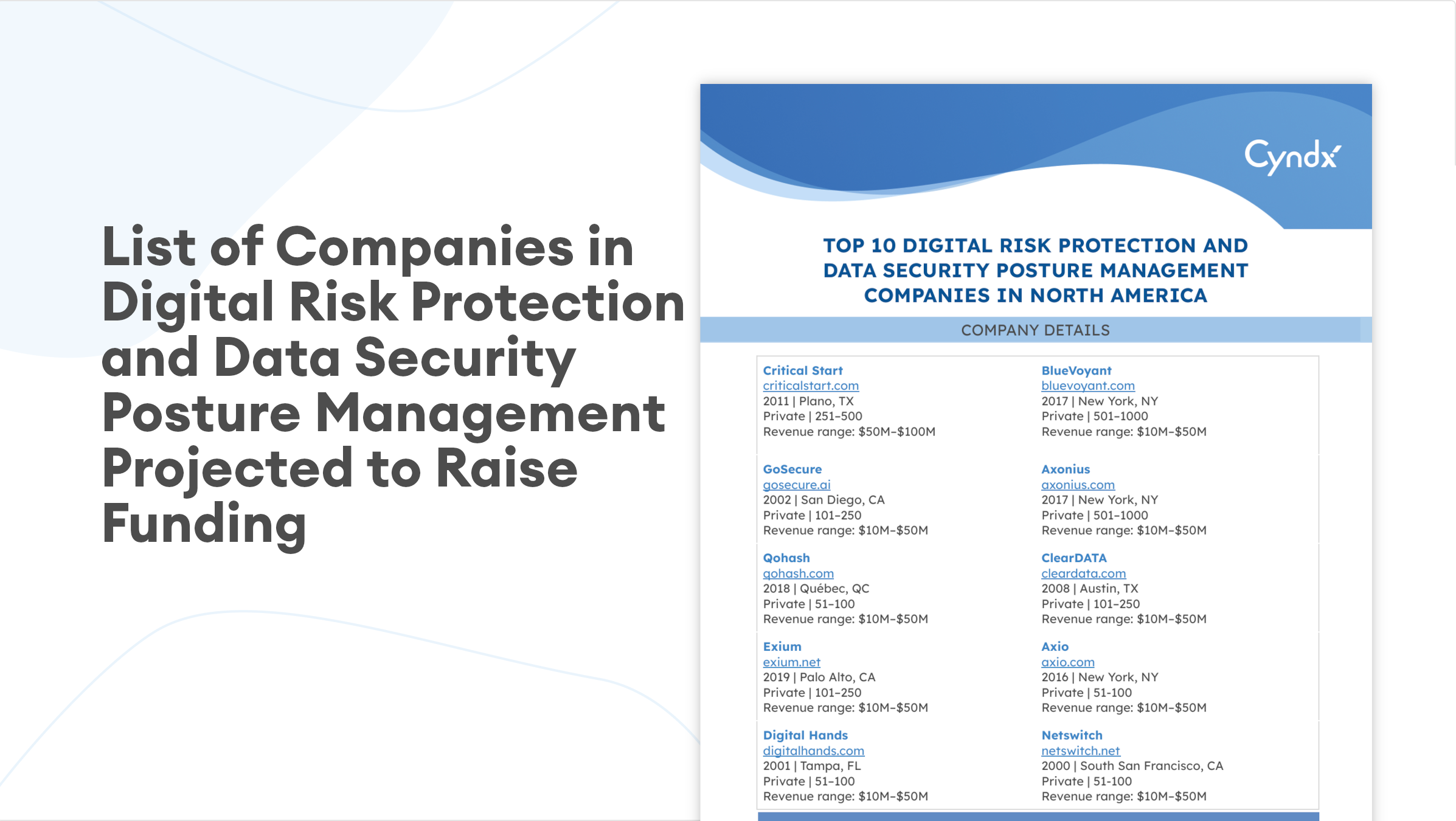

Free List: Top 10 Companies in Digital Risk Protection and Data Security Posture Management Projected to Raise Funding

Predictive algorithm gives investors head start on new opportunities

Why Rare Earths and Critical Materials Are the New M&A Gold Rush

As global industries pivot toward cleaner energy, advanced tech, and

The Future of the Investment Banking Analyst: Augmented, Not Replaced

Forget everything you've heard about artificial intelligence (AI) stealing Wall

The Sparkle of the 4th: What Makes the $3B Fireworks Industry Boom

As America gears up for another spectacular 4th of July

Agentic Workflow: How AI Agents Research, Analyze and Review Deals

The dealmaking game just got a major upgrade, and it’s

Cyndx Just Launched Scholar, And It’s Going to Change How You Research Deals Forever

Research reports that used to take weeks? Scholar does them

Transforming to an AI‑First Enterprise: The Role of Corporate Development

A decade ago, corporate development teams lived in spreadsheets and

How CPA Firms Became the Hottest Target in Private Equity

For decades, accounting firms were viewed as the buttoned-up corner

The Great Summer Getaway and How Small-Group Tours Are Leading the Travel Boom

Memorial Day doesn’t just honor those who served in the

Why Rare Earths and Critical Materials Are the New M&A Gold Rush

As global industries pivot toward cleaner energy, advanced tech, and

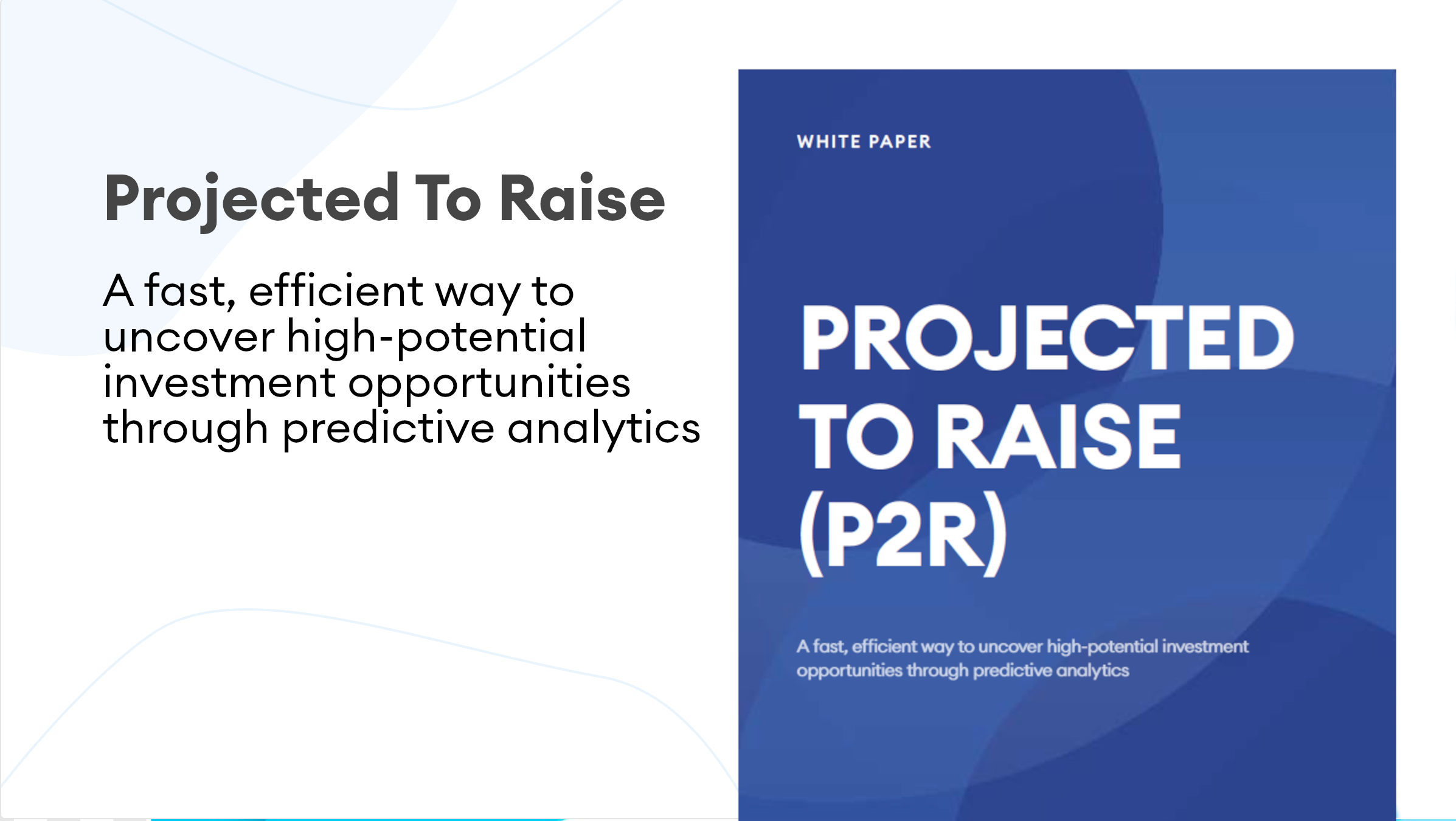

White Paper: Projected To Raise (P2R)

As dealmaking becomes more competitive, investors are under pressure

Press Release: Upcoming Webinar on AI Innovations in Deal Sourcing

We are excited to host a webinar titled “Learn How

The Future of AI-Driven Deal Origination

Private company data has traditionally been unstructured, opaque and hard

Cyndx Projected2Raise: Predicting Private Firms’ Capital Needs

Predictive algorithm gives investors head start on new opportunities

Identify Companies Projected to Raise in the Next 6 Months

Cyndx recently integrated a new AI-driven feature called “Projected to

Cyndx Announces Investment by Rakuten Capital

Funding to accelerate product development and support global expansion NEW