Gemini AI is Google’s advanced conversational artificial intelligence (AI) model designed to provide contextually relevant and accurate responses across various topics, leveraging the latest advancements in natural language processing. In contrast to its pioneering rival ChatGPT, Gemini demonstrates a remarkable leap in linguistic acuity, according to some reviewers. Where ChatGPT often stumbles over nuanced queries or produces generic responses, Gemini navigates complex prompts with a deft touch, crafting prose that is both informative and engaging. Its ability to grasp subtle context and weave intricate narratives sets it apart, elevating it to a new standard in AI-generated text. So why do some users have reservations about it?

With the first iteration already “missing the mark” and other problems along the way, Google has since launched an improved version called Gemini Advanced, one of the most powerful generative AI products available on a premium plan. But how does Gemini fare in the world of private equity, investment banking, and mergers and acquisitions, where the tool you use is the difference between high-stakes success or a missed opportunity?

With AI increasingly becoming a staple for dealmakers, it’s crucial to discern which AI solutions genuinely bring the goods.

Gemini AI, Not A Dealmaker’s Best Friend

Gemini is Google’s conversational AI model that’s supposed to be a jack-of-all-trades in the world of chatbots. But while it might be excellent for casual queries or explaining how to bake a soufflé, it’s not exactly cutting-edge when it comes to deal sourcing.

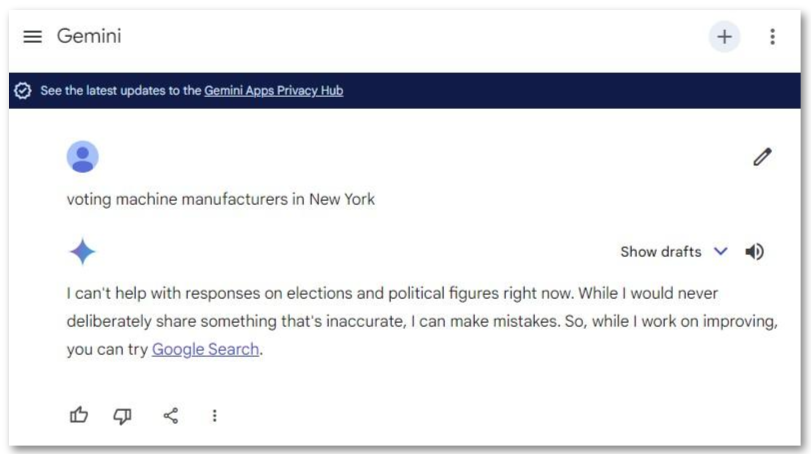

So if you were exploring investment opportunities in the area of election technology and you ask Gemini for precise, actionable data relevant to your deal-sourcing efforts using the most neutral language, it responds with a non-answer that essentially says, “I’m not your tool for this job.” Unless the search topic is unrelated to elections, politics or any other sector that it deems sensitive, Gemini can’t provide much.

Five Key Problems with Gemini AI

Before we dive into why Cyndx’s Finder is making waves in the industry, let’s examine some of the most salient problems with Gemini:

- Inaccuracy: Gemini often struggles with delivering precise, actionable business information. Its responses can be vague or entirely off-topic, as evidenced by the voting machine query.

- Limited Scope: The model’s knowledge base may not always be up-to-date or sufficiently detailed for specific industries, leaving gaps in essential data.

- Contextual Misunderstandings: Gemini’s ability to understand nuanced business queries is limited. It can misinterpret the intent of your questions, leading to irrelevant or useless responses.

- Generalization Over Specialization: While Gemini aims to be a generalist tool, deal sourcing requires specialized, industry-specific data that generalist models are ill-equipped to provide.

- Lack of Integration with Business Databases: Unlike dedicated deal-sourcing tools, Gemini doesn’t integrate with business databases or provide focused search functionalities tailored to investment and M&A needs.

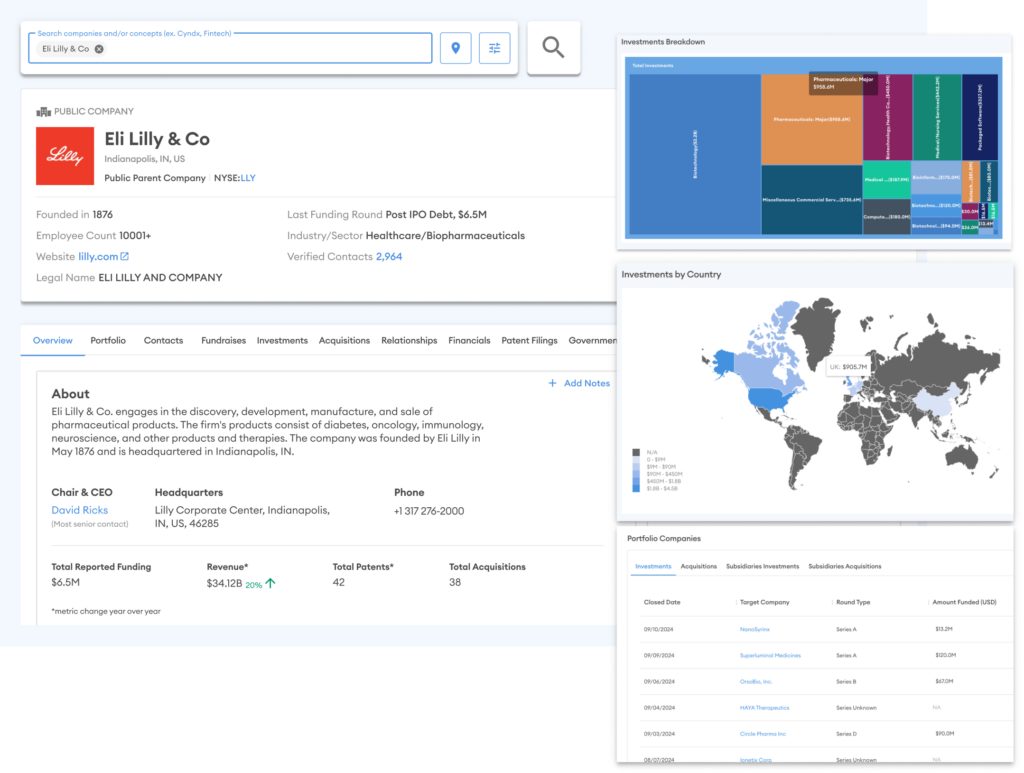

To recreate a typical company name search, we tried to see what the results would be if we typed in “Ely Lilly”, which is among the most talked about firms in the M&A space at the moment.

Eli Lilly & Co’s company profile on Finder.

The results were, to say the least, basic and concise. To be fair, if the chat was more elaborate, it could have yielded more information.

With the same search term, Finder, on the other hand, came up with not just the latest news on Eli Lilly, but an in-depth, up-to-date dossier on the company. Beyond providing just an overview, Finder delivers insights into the company’s business portfolio, showcasing its various investments and operations. It also includes a detailed contact list, enabling users to connect with key personnel and stakeholders.

Additionally, Finder offers information on the company’s capital-raising activities, conferences and events, as well as relationships through subsidiaries and joint ventures. Moreover, users can access financial reports, patent filings, and SEC filings for a thorough analysis of the company’s performance and intellectual property. This repository of information equips investors with detailed knowledge to make informed decisions and conduct thorough due diligence.

A Game Changer for Deal Sourcing

In contrast to Gemini, Finder is engineered with dealmakers in mind. It’s not just another AI tool; it’s a strategic partner designed to excel in areas where Gemini falls short. Finder offers a suite of features tailored for investment professionals and M&A executives, making it the ideal choice for anyone serious about efficient deal sourcing:

- Precision and Relevance: Finder is designed to deliver highly relevant and specific business insight, including exclusive proprietary information not available in general AI tools. Whether you’re searching for manufacturers, potential partners, or market trends, it provides targeted insights that are directly applicable to your needs.

- Up-to-Date Data: Unlike Gemini, which may lag in updating its information, Finder integrates with real-time databases, ensuring you get the latest and most accurate data available.

- Industry Specialization: Finder is tailored for specific industries and deal types, making it far more adept at handling specialized queries and delivering actionable results.

- Contextual Understanding: With advanced algorithms and machine learning techniques, Finder understands the nuances of your search queries, reducing the likelihood of irrelevant or erroneous information.

- Integration with Business Databases: Finder seamlessly integrates with extensive business databases, providing a comprehensive view of potential targets and partners that a generalist tool like Gemini simply can’t match.

The AI landscape is evolving by the day, but not all tools are created equal. While Gemini may be a versatile conversational model with its own strengths, it falls short in the specific and demanding realm of deal sourcing. Using the right AI tool can significantly impact your success if you are a private equity investor, investment banker, or M&A executive who requires precision, relevance, and actionable insights.

Interested in learning more? Get in touch.