A capitalization table, also known as a cap table, is a spreadsheet or table that lists all your company’s securities, such as stocks, options, equity, warrants, etc., and who owns them. Although all businesses use cap tables, startups and early-stage companies most commonly use them to show their equity capitalization or total ownership capitalization. A cap table includes a company’s equity ownership capital, like common equity shares, preferred equity shares, warrants, and convertible equity.

If you just started a company or are in the early stages of building your business, chances are you’ve heard of cap tables and are wondering whether one’s necessary for your startup. Cap tables are essential for a variety of reasons. As a founder, understanding equity and company ownership are critical as your company grows and develops. A cap table can also help illustrate your startup’s overall health to investors when you get to the fundraising stage. However, after a few funding rounds, cap tables become more complex as potential sources of funding like initial public offerings (IPO), mergers and acquisitions, and other transactions are listed.

When are Cap Tables Used?

Private companies typically use cap tables to provide information on a company’s investors, shareholders, and market value. Founders and entrepreneurs, venture capitalists, angel investors, and investment analysts can review a company’s history in issuing new securities, ownership dilution, and employee stock options.

A few ways that startups and pre-IPO companies leverage cap tables include:

1. To understand and distribute equity

Founders and cofounders of a new company need to agree on their equity distributions. A cap table outlines the ownership structure, including how much equity is allocated to each founding team member. By capturing this in writing, founding teams can avoid conflicts later about relative company ownership and shares.

2. To raise funding

Since investors will ask for a percentage of your company, it’s essential to know precisely what you’re giving up if you’re looking to raise funding. Potential investors will look for details about company ownership and changes since previous funding rounds. An updated cap table will give insights into a company’s potential growth and success and any legal issues.

You’ll also be able to organize your company structure and keep track of any changes to company structure based on your decisions. For example, you’ll be able to see how new fundraising rounds will impact your shareholder group.

3. To negotiate term sheets

Every funding round has a term sheet negotiation stage. Your cap table will give investors the overall health of your company and provide you with clarity around your company’s ownership structures. You can also understand what will happen to your ownership stake and company control at different valuation levels and determine how issuing new options before or after financing will affect your company. Having a clear idea of how things like options and shares will impact your company will enable you to determine how much to ask for and where to draw the line during the negotiation stage.

4. To manage employee options

Stock options are a great way to align employee incentives with your company’s objectives. Employees can receive options as part of their compensation; they typically can buy or sell the shares at a fixed price before a certain date.

A cap table shows the number of options available to issue at any given moment, allowing founders to keep track of your options. Information typically includes the date, receiver, number of shares, cost, fixed price, and number of options used to date.

Managing Your Cap Table

When you’re starting or growing a new company, having a list of your company’s ownership distribution in writing will help you stay organized and strategically plan for your future. Keeping your cap table accurate from the very beginning will provide you with valuable insights into your financial decision’s impact on your company market value and aid in your decision-making process at different stages of growth. In the early days, you may consider using Excel spreadsheets – when you don’t have outside investors. However, this manual process quickly becomes unreliable and inefficient when you begin your funding process.

Additionally, when you start looking for investors, a cap table will be essential in illustrating your business’ potential growth. One of the ways investors will evaluate your company’s health is by seeing that you are reserving enough equity for yourself and your future employees. A cap table can demonstrate your company’s health and provide a smoother process for getting to the negotiation stage with investors.

How is a Cap Table Structured?

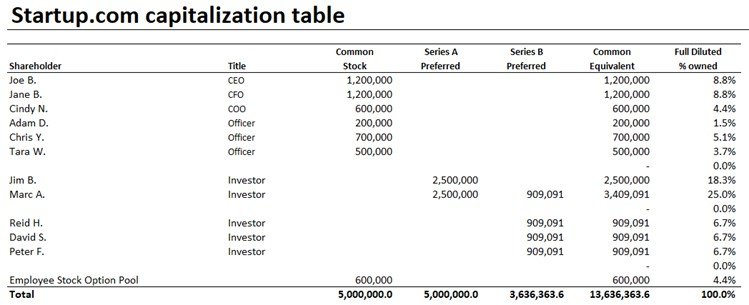

Overall, a cap table will show all your company’s securities. Although there are several ways to make one, a basic cap table lists each type of equity and the individual holders of each type. However, the data will vary on your business’s stage and the metrics you hope to track. Here is an example of a basic cap table:

Source: Wall Street Prep

The common elements that will need to be updated include:

-

Valuation: changes to share prices

-

New shareholders

-

Reserve/restricted shares

-

Debt that has converted to equity

-

Total outstanding shares

-

Remaining authorized shares

Cap Table Management Best Practices

There are various ways to make a cap table, and the right one depends on your company’s stage and equity structure. Most founders choose to build one with Excel or use a cap table template. However, as mentioned earlier, spreadsheets quickly become inefficient when you have to track your ownership interests alongside investor stakes and employee stock options.

When managing your cap table, it’s important to ensure that your cap table is always up-to-date, well-managed, and well-understood. Since your cap table will scale as your company scales, proactively updating the information with each new activity will enable you to keep track of your company’s securities. Additionally, your cap table should look professional and be easy to follow because at some point you will need to share it with prospective investors.

As your company grows and you gear up to raise a round of funding you should leverage a cap table management platform which handles much of the manual work for you, provides scenario modeling on the impact of a potential funding round, and eases the process to issue shares to new investors. Cyndx Owner offers easy-to-use cap table management software to help businesses efficiently manage their equity distribution. Owner is designed to facilitate portability of cap table data and meet the needs of companies regardless of where they are in their lifecycle. Owner is available in three subscription models: Freemium (for up to 50 shareholders), Premium, and Enterprise.

Benefits of Using a Cap Table Software

As your company grows, your cap table spreadsheet will become more complicated and harder to manage. Spreadsheets are prone to error as a designated person will have to manually update your business’s cap table when your company goes through significant changes related to ownership. Additionally, a spreadsheet is less secure as data can easily be lost and even permanently erased.

Cyndx Owner is a cap table software that offers a centralized platform on the cloud so that you can create professional and easy-to-understand cap tables. With Cyndx Owner, you can run multiple fundraising simulations and quickly perform accurate waterfall analyses to understand precisely how fundraising will impact ownership. You can also manage employee incentive plans and share cap tables with your team and other stakeholders. The best part of Cyndx Owner’s cap table software is that you can scale your business without having to worry about the complications that come with managing and updating a spreadsheet.

Try Cyndx Owner’s Cap Table Management Software for free today.