As global industries pivot toward cleaner energy, advanced tech, and shifting geopolitical alliances, rare earth minerals and critical materials have emerged as the new strategic, albeit unlikely, battleground. These elements — from lithium and cobalt to neodymium and graphite — power everything from electric vehicles and smartphones to missile systems and wind turbines. And now, the latest minerals cooperation deal between the United States and Ukraine has vaulted the sector into even sharper focus.

Signed in April 2025, the agreement aims to develop Ukraine’s vast but underutilized mineral resources in partnership with American companies, signaling a new phase of economic alignment and resource diplomacy between the two nations. For investors, dealmakers, and strategists, critical materials are no longer just inputs for products. They’ve become leverage, driving a new wave of mergers and acquisitions (M&A), and cross-border partnerships.

Ukraine’s critical materials reserves, including rare earths and battery-grade minerals, represent untapped potential that could help reduce U.S. dependency on China and Russia. For Ukraine, it’s an economic and geopolitical lifeline; for the U.S., a strategic diversification. The deal is already triggering a flurry of activity among mining, logistics, and refining firms eager to establish a foothold before competition intensifies. It’s the kind of event that tilts the playing field — and savvy dealmakers are paying close attention.

Critical materials — a category encompassing lithium, cobalt, rare earth elements, and other essential inputs — are no longer niche commodities. They’ve become essential to the global economy, underpinning everything from semiconductor manufacturing to advanced defense systems. As demand skyrockets and supply chains remain vulnerable, countries and companies alike are racing to secure access, build refining capacity, and lock in long-term contracts.

The U.S. has responded with a mix of incentives, regulation, and industrial policy aimed at reshoring supply and reducing exposure to geopolitical risks. The Inflation Reduction Act, CHIPS Act, and Department of Energy-backed funding have all played a role in accelerating domestic production and investment. But public policy alone can’t close the gap. It’s corporate capital — and dealmaking — that’s picking up the slack.

Who’s Leading the Charge in the U.S.?

A search on our deal-sourcing platform, Finder, found numerous rare-earth companies, including five U.S.-based companies that stand out as leaders in the rare earths and critical materials space. Each plays a pivotal role in reshaping domestic supply chains and strengthening America’s industrial base:

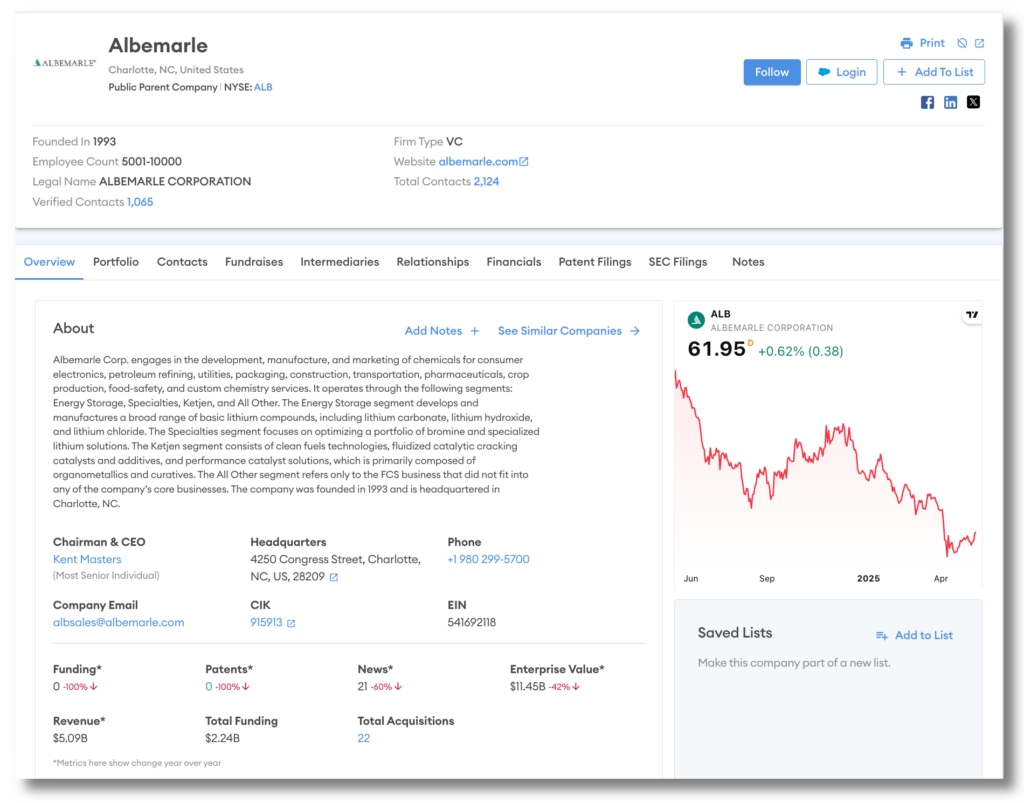

Albemarle Corp. – A major player in lithium production, Albemarle is vertically integrated and heavily involved in R&D and refining. It’s also actively pursuing acquisitions to secure future supply.

- Enterprise Value: $11.45B

- Revenue: $5.09B

- Total Funding: $2.24B

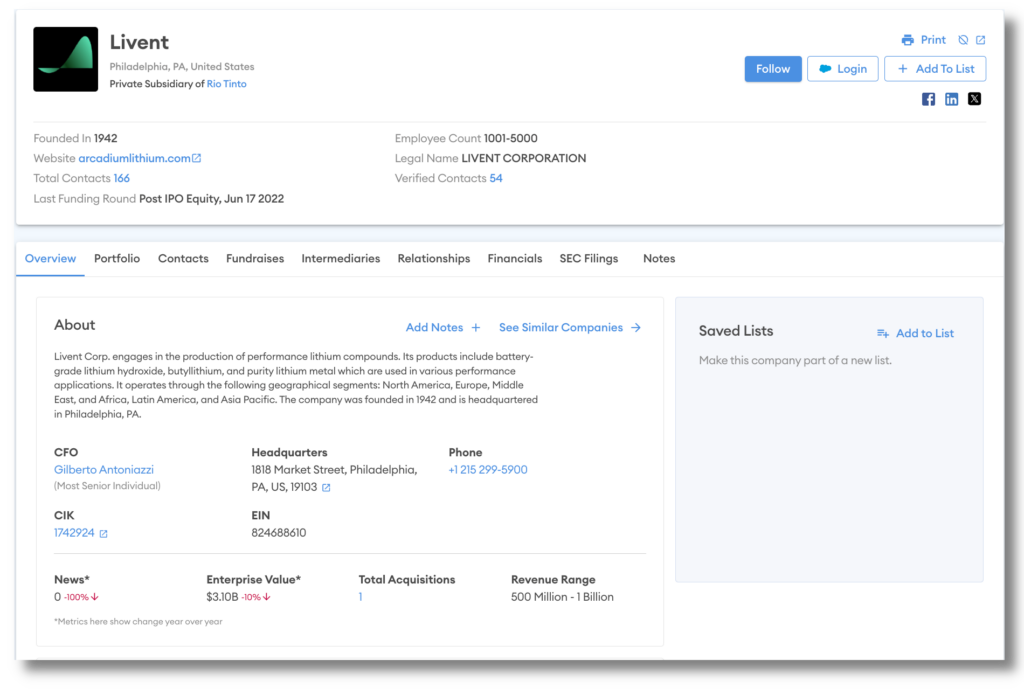

Livent/Arcadium Lithium – A lithium producer with operations in the U.S. and Argentina, Livent is central to the battery-grade lithium supply chain. Its merger with Allkem positions it as a global powerhouse.

- Enterprise Value: $3.10B

- Revenue Range: $500M – $1B

- Total Funding: $908.50M

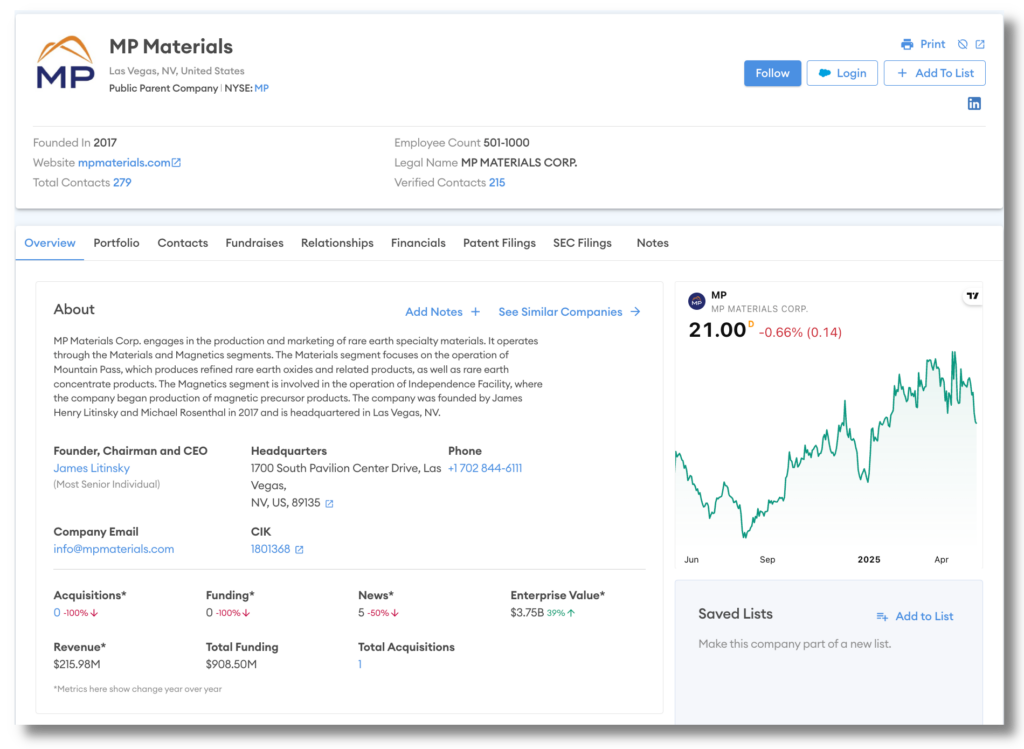

MP Materials – Operating the only rare earths mine and processing facility in the U.S. (located in Mountain Pass, California), MP Materials is a cornerstone of America’s rare earths strategy. It recently expanded into magnet manufacturing to support EV and defense demand.

- Revenue: $215.98M

- Total Funding: $908.50M

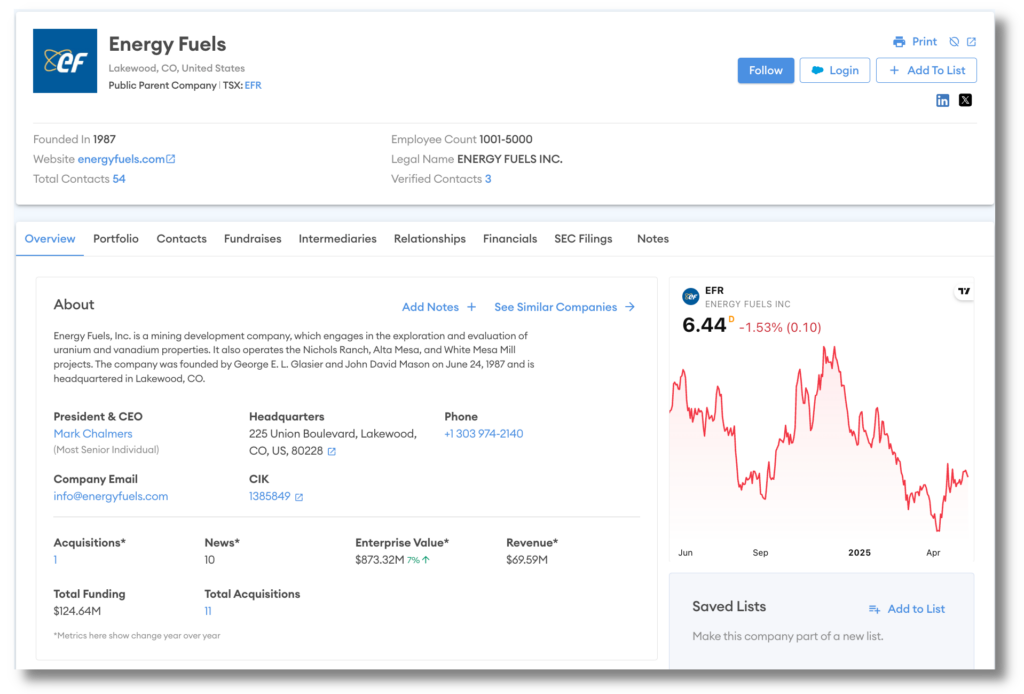

Energy Fuels Inc. – Known for its uranium production, Energy Fuels has expanded aggressively into rare earth processing. Its White Mesa Mill in Utah is being positioned as a critical hub for North American refining.

- Enterprise Value: $873.32M

- Revenue: $69.59M

- Total Funding: $124.64M

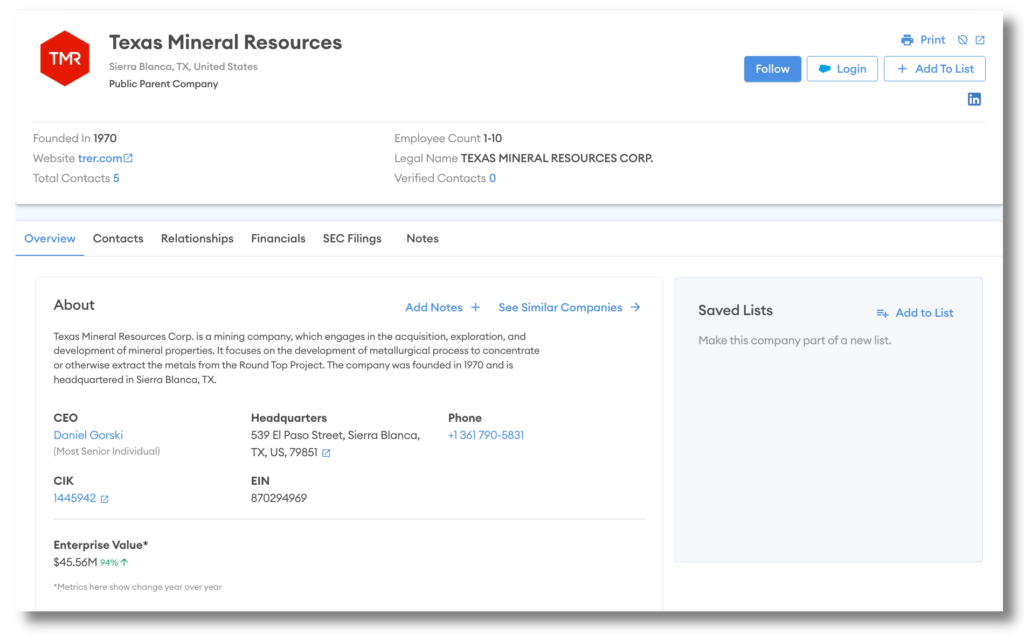

Texas Mineral Resources Corp. – This company is focused on developing the Round Top heavy rare earths project in Texas, a site considered key for diversifying away from Chinese-controlled supply.

- Enterprise Value: $45.56M

Trends Reshaping the Sector

With global supply chains under pressure and the energy transition accelerating, rare earths and critical materials are no longer niche but strategic. In 2025, five macro trends are shaping how governments, investors, and companies compete:

- Trade Pacts and Strategic Alliances Go Global – The U.S.-Ukraine minerals cooperation deal is just one in a wave of cross-border partnerships aimed at securing critical materials. From Japan and Australia to the EU and Canada, nations are building bilateral and multilateral agreements to reduce dependency on China and stabilize supply chains.

- Onshoring and Processing Investments Accelerate – Washington is doubling down on downstream capacity — from refining to magnet production — with new subsidies and funding rounds backed by the Department of Defence. The result is a spike in joint ventures and acquisitions across industrials and clean tech aimed at reshoring critical mineral processing and manufacturing.

- Private Capital Floods the Sector – Private equity, sovereign funds, and institutional investors are repositioning critical minerals as strategic, inflation-resilient assets. Deal volume is rising in mining tech, battery metals, and processing infrastructure as capital chases energy transition upside and long-term scarcity premiums.

- Tech Innovation and Circular Economy Momentum – Advanced recovery methods, AI-enabled exploration, and industrial waste reprocessing are gaining traction. Western companies are reviving gallium, lithium, and rare earth recovery from electronics and industrial byproducts — turning waste streams into strategic supply.

- Demand Spike Driven by Clean Energy and Geopolitics – Lithium and rare earth usage rose double digits in 2024, and the IEA projects continued acceleration. As the energy transition ramps up, securing a diversified and resilient supply is now a national priority.

Mergers and Acquisitions Heat Up

Unsurprisingly, this volatile mix of supply uncertainty and surging demand has created a hotbed for M&A. The sector saw up to $3.5 trillion in announced deals last year — a number poised to rise in 2025 as new players enter and incumbents consolidate. Vertical integration is a dominant strategy: mining firms are buying refiners, and battery manufacturers are securing upstream assets.

Private equity is also moving aggressively, targeting niche suppliers, specialty processors, and firms with proprietary extraction or recycling technology. With valuations still trailing broader tech and energy multiples, investors see room for upside — and first-mover advantage.

Sourcing Smarter Deals with Finder

Cyndx’s platform gives dealmakers a critical edge. Our deal-sourcing platform, Finder, lets users surface and screen thousands of private companies based on granular filters — like mineral focus, ESG credentials, refining capacity, or investor history. Combined with AI-driven discovery and customizable tracking, the platform helps firms move fast on opportunities before the rest of the market catches up.

As critical materials begin to dictate industrial power, dealmakers who know where to look — and act first — will shape the next chapter of global trade. The race for rare earths isn’t slowing down. It’s just getting started, so contact us and get ahead.